Buying a condominium is always exciting and challenging—most especially for first-time buyers. Perhaps the most essential dance step in this real estate waltz is the down payment. It’s the chunky upfront investment that can sometimes stand between you and the warm interiors of your dream condominium. But what exactly is a down payment? How much should you shell out, and what are the best hacks to ensure you have your condo’s down payment?

We cover all the nitty-gritty of condo down payments in this comprehensive guide, and you’ll definitely approach this milestone with confidence. Whether you are on a quest to find that dream condominium with breathtaking views or are looking for a more modest space to call home for the first time, understanding the ins and outs of down payments will be essential for your property purchase to be a success.

Minimum cash payment, active housing loans, condo loan, initial payment, condominium unit, second residential property.

Understanding Condo Down Payments

Once you are ready to buy a condo, your first financial barrier will be the down payment. This is the initial payment you put down upon the full purchase price of the property. It is usually a percentage of the price and will vary upon certain factors. For a condo, this percentage is more often less than that required of a conventional home, making it an excellent option for first-time buyers who don’t have many savings.

What Factors Affect Your Condo Down Payment

Several factors will determine the amount of down payment that you will have to make when buying a condo. Here, we deal with the three main ones:

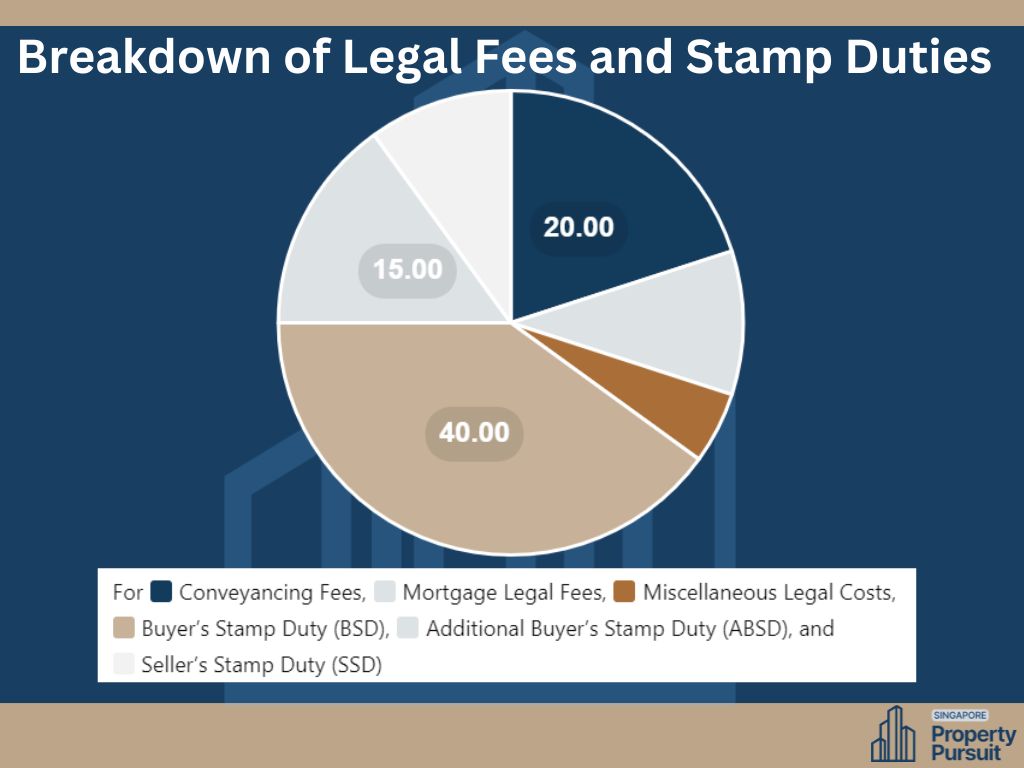

Additional Buyer’s Stamp Duty (ABSD)

Some jurisdictions, such as Singapore, have ABSD – an additional cost on home buyers buying a second or other residential property. Understanding this and making a budget is something that will prevent you from surprise during the buying process. Currently, you will get the following rates:

- 12% for foreigners buying residential property

- 15% for entities buying residential property

- Singapore Citizens and Permanent Residents get the first residential property free of ABSD. But they must pay a 7% rate on the second home purchase.

Buyer’s Stamp Duty (BSD)

This is a taxation much like ABSD. However, in this case, it is a tax on documents signed relevant to the purchase of your property. You will need to understand and calculate this when budgeting for your down payment. Current buyer’s stamp duty rates in Singapore:

- 1% on the first S$180,000 of the price of the property

- 2% on the next S$180,000 of the price of the property

- 3% on the remainder of the price of the property exceeding S$360,000

For example, if you buy a condo for S$500,000, the BSD is:

- 1% of the first S$180,000 = S$1,800

- 2% of the next S$180,000 = S$3,600

- 3% of the remainder (S$140,000) = S$4,200

Total BSD = S$1,800 + S$3,600 + S$4,200 = S$9,600

Computing the ABSD and BSD amounts can sometimes be tricky. It is always a good idea to seek the advice of a professional or use an online calculator to get a close estimation of your costs.

Loan-to-Value (LTV) and Minimum Cash Downpayment

LTV is the proportion of the property’s value you can borrow from a lender. The higher the LTV, the less you have to pay out of your pocket. But then, you also take on a higher mortgage. Most mortgage loans come with a minimum cash downpayment requirement that the lender will not waive. For instance, in Singapore, a minimum cash downpayment for first-time homebuyers is 5% of a property’s purchase price. A mortgage can finance the remaining 95% of the property.

Here are some keywords that should be used in the article: resale condos, monthly payments, outstanding loan, private property, property BSD rates, residential properties, third and subsequent properties, loan term extends, Singapore citizen.

Central Provident Fund (CPF) Savings

CPF savings are a key resource for property buyers in Singapore. They can be used to fund down payments, monthly mortgage payments, and other property-related expenses. Understanding how CPF can be utilized effectively is crucial for homebuyers.

Standard Down Payment Options for Condos

The type of mortgage you choose will significantly affect your down payment requirements. Here are the most common loan types and their associated down payments:

- Conventional Loan: Typically, you’ll find the down payment for a conventional loan can range from 10% to 20% of the property’s purchase price.

- FHA Loan: These government-backed loans can provide relief for those with a lower credit score and less available cash. An FHA loan can require a down payment as low as 3.5% of the purchase price.

- VA Loan: If you’re a veteran or serving in the military, a VA loan could be an option with no requirement for a down payment.

For first-time condo buyers, comparing these options can lead to significant savings in the near term. It’s important to note that while a lower down payment can mean gaining access to homeownership sooner, it can also lead to higher monthly mortgage payments.

Beyond the Down Payment: Additional Condo Ownership Costs

The down payment is just the beginning of the financial commitments associated with owning a condo. Other significant upfront costs, such as closing costs, appraisal fees, and the first year’s insurance premium, should be factored into your overall financial planning. Additionally, there will be recurring costs like property taxes, homeowner association (HOA) fees, and maintenance expenses to consider. Given that condos typically have HOA fees, it’s essential to understand their structure and ensure they fit within your budget.

These additional costs can vary widely depending on the location and property, so it’s crucial to research and account for them before committing to a purchase. Underestimating the overall financial responsibility of condo ownership can lead to significant stresses and strains on your financial health.

Tips for Saving for Your Condo Down Payment

A little bit of fiscal prudence can go a long way when saving for a condo downpayment. Here are practical tips to maximize your efforts:

Set a Realistic Goal

Identify the requirement and know when this is needed, then work out a feasible timeline.

Open a Dedicated Savings Account

Separating your down payment funds from your regular accounts will ensure that you do not spend the money on other things.

Automate Your Savings

Many banks have this feature, where you can automatically transfer money straight to your savings account once your salary comes in. Meaning, your down payment fund is growing without thinking too much about it.

Increase Your Income

You may do this by getting an extra job, freelancing, or even asking your boss for a raise.

All the above activities should be able to put you in a position where you are able to work on your down payment consistently, which shows the lenders that you are a disciplined person when it comes to your finances and that you are prepared for the future.

Getting Pre-Approved for a Mortgage

Every buyer of a condo should regard the pre-approval process as important. This gives you a concrete budget that allows you to shop around for the kind of properties you can really afford. On top of that, pre-approval can make your offer more attractive in a hot market, as it shows sellers that you are a serious, good buyer.

In general, the pre-approval will require the submission of financial documents, such as tax returns, pay stubs, and bank statements. The information is then reviewed by the lender, who decides on the amount of mortgage, as well as the interest rate and down payment requirements.

Keywords to include: bank loans, pay stamp duty, downpayment amount, substantial downpayment, financial commitment, housing developer, executive condominium, other outstanding loans, monthly repayments, personal finance, CPF savings, loan term, minimum amount.

Alternative Payment Option

Deferred Payment Scheme (DPS)

For buyers who may not be ready to make the full downpayment upfront, some new launch condos offer a Deferred Payment Scheme (DPS). This allows you to delay a portion of your payments until the condo is closer to completion, giving you more flexibility in managing your cash flow.

However, there’s a catch—properties that offer DPS usually come with a higher purchase price, which may offset the benefits of deferring payments. Before choosing this option, it’s important to evaluate whether DPS aligns with your financial plans. Read about- Is a Deferred Payment Scheme (DPS) Right for You?

CPF Strategies to Reduce Your Downpayment

While this guide covers general downpayment requirements, did you know you can use CPF to reduce your upfront costs? From OA savings to the Housing Withdrawal Limit, understanding CPF rules can make a big difference. Ways CPF Can Help with Your Downpayment

Downpayment Rules for Executive Condos

Did you know that Executive Condos (ECs) have different downpayment requirements compared to private condos? If you’re eligible, you can use CPF and HDB grants to reduce upfront costs, making ECs an attractive option for first-time buyers. Learn more about EC financing and how it compares to private condos. Executive Condos: How Do Downpayments Work?

Conclusion: Your Condo Ownership Journey Starts Here!

Owning a condo involves a combination of exciting milestones and practical steps. Having this manual, you now have the knowledge that will take you to the first and major checkpoint, which is the down payment. With strategic thinking about various factors that will affect your down payment, examining your loan options, and considering possible aid programs, the door to your first condo is about to be unlocked.

Remember, that buying a condo is a big choice and it is both a financial investment and personal investment that you have to make. So long as you approach this process with knowledge and preparation, you will be able to make decisions that are sound and will work in your favor for years to come. As it is in real estate and in life, so the saying goes that informed decision-making is always the precursor to successful results. Your condo journey has exciting times ahead and the first page of your homeowner’s manual is being written as we lay down the ground rules for your down payment. Welcome to step one of your ownership odyssey!

Related Insights: