Singapore’s real estate landscape is as dynamic as it is prestigious, with properties like Executive Condominiums (ECs) standing out for their unique blend of public and private housing features. But is an Executive Condo the right avenue for your property investment or homeownership dreams? If you’re a Singaporean or a Permanent Resident with a longing for the kind of living that ECs promise, then this comprehensive guide is tailored to help you make an informed decision.

This article will take you through a step-by-step process of understanding ECs in detail, starting from the eligibility criteria to evaluating your personal needs and financial goals. We’ll cover everything from the nitty-gritty of ownership to payouts, and even potential pitfalls you must consider. Whether you’re a first-time buyer, a young professional looking to invest, or a family planning its next property chapter, you’re bound to find the answers you seek within these pages. With private property prices on the rise and competitive offerings from private developers and property developers, understanding the nuances of ECs becomes crucial. Additionally, the option to consider a resale flat might also play into your decision-making process.

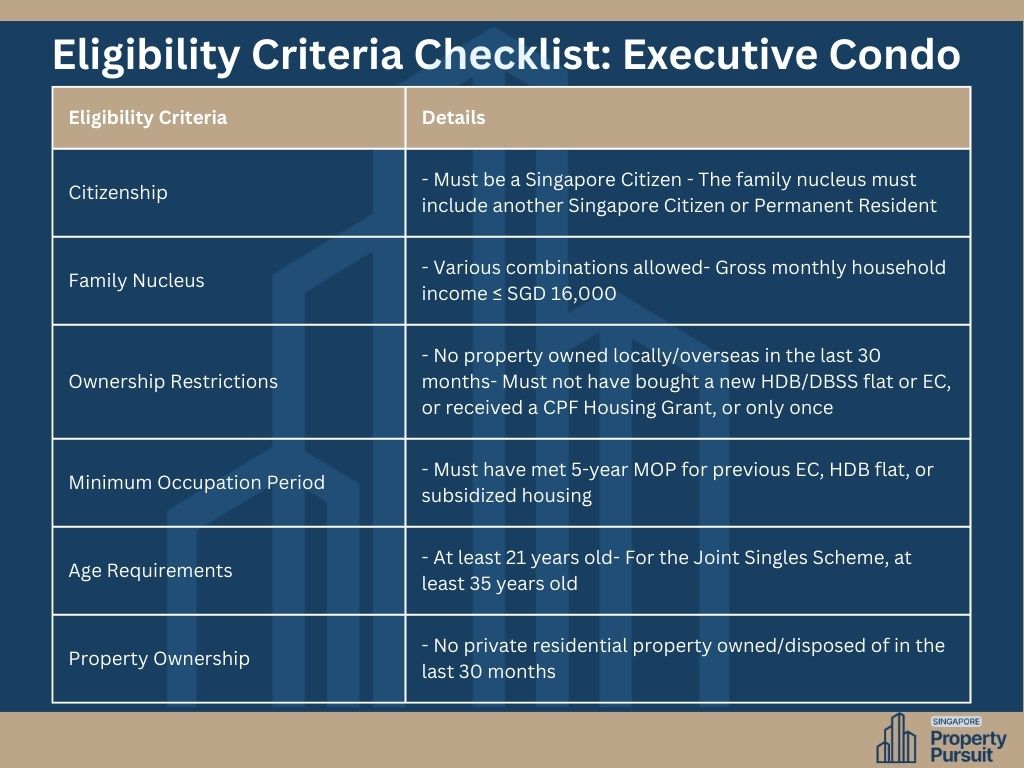

Before you can even consider investing in an Executive Condo, you need to tick all the eligibility boxes set by the Housing and Development Board (HDB) in Singapore. Understanding these criteria is the vital first step that can save you from heartache down the line. Here’s a breakdown of what you need to know:

Singapore Citizen or Permanent Resident

ECs are exclusively for Singapore Citizens and Permanent Residents, a fact that narrows down the potential pool of buyers. If you meet this criterion, you’re one step closer.

Property Ownership

If you currently own any property, there are specific guidelines you must follow. For HDB owners, you’ll need to dispose of your flat within a certain timeframe or meet the exemption criteria. Singles may have additional restrictions, so family composition plays a role here too. When considering an EC launch, you must also understand the implications of owning a strata titled apartment, as these rules apply to EC unit bought as well.

Family Situation

The rules around family composition and size might seem complex, but they are designed to ensure ECs serve the right population. From singles to married couples to extended families, these ECs are designed to accommodate a variety of household types.

Income Ceiling

There’s a cap on the maximum monthly household income you can have to purchase an EC. This figure is regularly updated, and you must not exceed it to be eligible. Additionally, understanding the resale levy is crucial if you’re planning to buy a resale EC.

Remember, the criteria differ slightly if you’re eyeing a new launch versus a resale EC, so be sure to check the current standards applicable to you. Proximity to amenities such as an MRT station can also enhance the appeal of your chosen EC, making it a more attractive option for potential home buyers.

Step 2: Exploring the Benefits

Once you’re clear on your eligibility, it’s time to explore what makes ECs such an attractive choice for discerning buyers. Here are some advantages worth noting:

Freehold Ownership

Unlike typical private condominiums, where you’re purchasing a lease, ECs offer the allure of freehold ownership, which means you own the land your unit is built on.

ECs have their own set of rules, but if you’re also considering a private condo, understanding the differences between freehold and leasehold properties is essential. Read more here: Freehold vs Leasehold Condos in Singapore: Which is Better?.

Modern Design and Amenities

ECs often boast innovative architecture and state-of-the-art amenities, setting them apart from older HDB developments. Think swimming pools, gyms, and smart home features that cater to the modern lifestyle.

Potential for Capital Appreciation

Historically, ECs have seen significant appreciation in value, making them a lucrative investment for those considering capital growth. This potential can make them particularly appealing to the aspirational investor.

Stepping Stone to Private Property

For many, ECs serve as a transitional phase between HDB flats and private condominiums, making them an important stepping stone in the property ladder.

Step 3: First-Time Buyers – What You Need to Know

If you are purchasing an EC as a first-time buyer, there are important considerations to keep in mind. From budgeting for your downpayment to understanding loan restrictions, getting familiar with the process will help smoothen your home-buying journey.

To better understand the financial aspects of purchasing an EC, including the required downpayment and financing options, check out our guide: First-Time Buyer? Condos Downpayment Explained.

Step 4: Evaluating Your Needs and Goals

Your individual aspirations and financial capacity are paramount to this decision. Reflect on the following:

Current Living Situation and Future Plans

Assess what an EC can offer that your current situation can’t. Perhaps you’re outgrowing your current space, or maybe you’re looking for something closer to the city.

Budgetary Constraints

Beyond the initial purchase, there are ongoing costs like maintenance fees and, of course, the mortgage. Learn more about what to expect in our guide: The Ultimate Guide to Condo Maintenance Fees in Singapore (For Beginners).

Preferred Location and Amenities

Location, as always, is key in real estate. Consider what locations are not only convenient but suit your lifestyle aspirations.

Long-term Ownership Plans

Are you looking for a forever home, or do you anticipate moving on within a few years? Your long-term plans can also influence whether an EC is the right choice, given the 5-year minimum occupation rule before selling.

Step 5: Understanding EC vs. Private Condo

While ECs share many features with private condominiums, there are also distinct differences:

Ownership Type

As previously noted, the land of an EC is freehold, but the units are subjected to a MOP and other regulations. With private condos, the land is typically leasehold.

Eligibility Requirements

EC entrance barriers are higher due to the government’s provision for first-time homeowners and boosting the public-private balance.

Government Restrictions

ECs are subject to a series of government regulations, including the aforementioned income ceiling and MOP, which are not applicable to private condos.

Price Point

You might find that ECs are priced slightly lower than private condos, given the government subsidies involved in their development.

Resale Conditions

After the 10-year MOP, resale conditions are less flexible than those for private condos. Expect to sell to other eligible EC buyers before the general market.

Step 6: Considering the Potential Drawbacks of an EC

It’s important to see both sides of the coin. Here are a few potential drawbacks to consider:

Higher Upfront Cost

While you might see an EC’s price tag as a bargain compared to a private condo, it’s significantly higher than an HDB flat’s resale value. Be prepared for a more substantial down payment.

Limited Availability

The supply of ECs is controlled by the government, which can lead to longer waiting times or a less robust market with fewer options.

Minimum Occupation Period

You’ll need to occupy your EC for at least 5 years before you can rent it out or sell it, which can be restrictive if your life circumstances change.

Resale Restrictions

Even after the MOP, there are certain limitations on who you can sell your EC to, and at what price. This control can affect your exit strategy.

Step 7: How to Buy an EC in Singapore

The buying process for an EC is not dissimilar to a private property. Here is a general roadmap:

Check Eligibility and Get Pre-Approved

Ensure that you meet the criteria and get a pre-approval for your mortgage to clarify your purchasing power.

Research and Apply for the EC Ballot

Research upcoming EC projects and apply for the ballot if there’s one you’re interested in. This is an essential step, as some developments are oversubscribed, and scoring a ballot can be competitive.

Select and Finalize

Once you’re successful in the initial ballot, you’ll be given a selecting unit opportunity. From there, it’s a finalization of the purchase.

Option Fee

The first step in your commitment to buying an EC is the payment of an option fee. This fee secures the option to purchase your chosen unit. It’s a part of the overall purchase price and varies depending on the cost of the unit but typically ranges from $2,000 to $20,000.

Sales & Purchase Agreement (SPA)

After paying the option fee, the next step is to sign the Sales and Purchase Agreement (SPA). This legal document outlines all the terms and conditions of the sale, including payment schedules, completion dates, and any penalties for breach of agreement. Buyers typically have up to three weeks from the date of the Option to Purchase (OTP) to sign the SPA.

Stamp Duty

Stamp duty is a tax paid on documents relating to the purchase of property, such as the SPA. The amount is based on the purchase price or market value of the property, whichever is higher. Paying stamp duty is a crucial step in the legal acquisition of property.

Read more in our glossary: What is Stamp Duty?.

Down Payment

Upon signing the SPA, a down payment is required. This amount varies depending on the loan tenure and whether you are taking a bank loan or a HDB loan, but it is typically 20% of the purchase price, part of which can be paid using CPF funds.

Progressive Payment Scheme

For new ECs under construction, payments are typically made progressively, aligned with the construction milestones. This means you’ll pay percentages of the purchase price at different stages of development, from foundation work to the final completion of the project.

Mortgage and Legal Fees

Securing a mortgage comes with its own set of fees, including legal fees for conveyancing services. These fees cover the cost of legal advice and the preparation of necessary documents for the property purchase and mortgage.

Maintenance Fees

Once you’ve moved into your EC, you’ll be required to pay monthly maintenance fees. These fees go towards the upkeep of common areas and facilities such as the lifts, swimming pools, and gardens. The size of your unit often determines the fee amount.

Understanding these financial commitments is vital in planning and budgeting for your EC purchase, ensuring a smoother transaction and long-term satisfaction with your investment.

Conclusion

Investing in an Executive Condo is a significant decision, one that requires thorough self-evaluation and research. By going through these steps, you are equipping yourself to make an informed choice. Remember, while this guide is here to help, nothing beats the advice of a professional well-versed in the Singapore property market. Engage with them to tailor this knowledge to your unique situation and take the first step towards your EC dream.