Navigating the real estate market in Singapore as a first-time homebuyer or an investor can be an intricate affair, especially when dealing with condo payment schedules. Understanding the intricacies of payment schedules for both new launch and resale condominiums in Singapore is paramount, not just for transparency, but for better financial planning and ensuring a smoother buying process. This article aims to demystify the payment schedules for both types of condos, providing you with the necessary insight to make informed decisions.

Understanding Condo Payment Schedules in Singapore

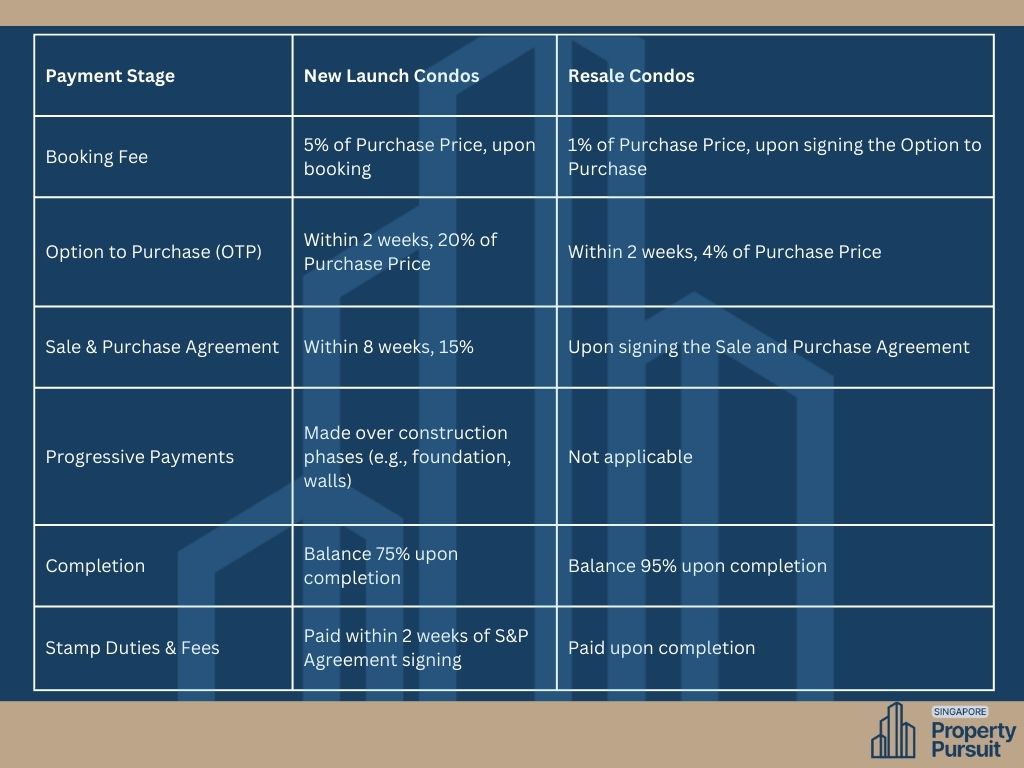

A condo payment schedule in Singapore outlines the timeline and payments required at each stage of purchasing your dream condo. Whether it’s a new launch property still under construction or a resale property that’s ready to move in, each comes with its unique payment timeline that ranges from the initial reservation to the completion. Understanding these schedules is crucial for managing your finances effectively throughout the buying process.

Unveiling the New Launch Payment Schedule

“New Launch” condominiums represent properties currently under construction that are available for purchase directly from the developer. Here’s a typical breakdown of the payment schedule for a new launch condo:

Option Fee & Exercise: Upon selecting your unit, you’ll pay an option fee, a percentage of the purchase price, securing the option to purchase the condo. You then have a timeframe to exercise this option by paying the balance of the down payment. Upon selecting your unit, you’ll pay an option fee, which typically ranges between 1% to 5% of the purchase price, securing the option to purchase the condo. You then have a timeframe, usually within 2 to 3 weeks, to exercise this option by paying the balance of the down payment.

Down Payment: Typically 20% of the purchase price, of which a portion can be paid using your CPF funds. The balance of the down payment, which makes up the remainder of the initial 20%, must be made within 8 weeks from the option date. This balance can also be paid using funds from your Central Provident Fund (CPF) or a combination of CPF and cash. Understanding the exact timelines for these payments is critical, as it ensures you have the necessary funds ready and prevents any delays in the transaction process. Additionally, keeping track of these deadlines helps in aligning your financial commitments with other expenses that may arise during the home-buying journey.

- Progressive Payment Stages: These payments correspond to construction milestones, such as completion of the foundation, framing, and so on. Each stage triggers a payment, gradually covering up to 60% of the purchase price.

Completion of Foundation (10%): The first progressive payment is made when the foundation of the building is completed, typically 10% of the purchase price.

Completion of Reinforced Concrete Framework of the Unit (10%): Another 10% is due once the reinforced concrete framework for your specific unit is completed.

Completion of Roof & Walls (5%): A 5% payment is triggered upon the completion of the building’s roof and external walls.

Completion of Windows & Doors Fittings (5%): When the windows and door frames are fully fitted, another 5% of the purchase price is payable.

Completion of Car Park, Roads, and Drains (5%): The completion of essential infrastructure such as car parks, roads, and drainage systems requires a 5% payment.

Notice of Temporary Occupation Permit (25%): A significant 25% is due when the Temporary Occupation Permit (TOP) is issued, allowing you to occupy the unit.

Issuance of Certificate of Statutory Completion (25%): The final 25% is paid upon the issuance of the Certificate of Statutory Completion (CSC), signalling the formal completion of the property.

- Legal Fees & Stamp Duty: Expect to incur legal fees and stamp duties, which add to the initial costs of purchasing your new home. Legal Fees: Legal fees for the purchase of a condo in Singapore generally range from 0.3% to 0.6% of the property’s purchase price, depending on the complexity of the transaction and the law firm engaged. It is advisable to obtain quotes from different legal service providers to ensure you get a competitive rate. Buyer’s Stamp Duty (BSD): The BSD varies based on the purchase price of the property. The rates are tiered as follows:

- 1% for the first S$180,000

- 2% for the next S$180,000

- 3% for the next S$640,000

- 4% for the remaining amount

Additional Buyer’s Stamp Duty (ABSD): Depending on the buyer’s residency status and the total number of properties owned, an ABSD may also apply. For Singapore Citizens purchasing their second property, the ABSD is 17% of the purchase price. For Permanent Residents buying their first property, the ABSD is 5%, and 25% for subsequent properties. Foreign buyers are subject to a 30% ABSD rate for any property purchase.

Understanding these additional costs and their variations based on property type and buyer profile is crucial for comprehensive financial planning.

Resale Condo Payment Schedule – A Different Journey

Resale condominiums are pre-owned properties that are ready to move in. The payment schedule for a resale condo usually looks like this:

- Option Fee: Similar to new launches, this fee secures your option to purchase the condo. For resale condominiums, the option fee generally ranges between 1% to 5% of the purchase price. This fee is paid to the seller to take the property off the market and grant you the option to complete the purchase.

- Exercise & Down Payment: Once you exercise your option, typically within 14 days, the balance of the down payment, usually 20% of the purchase price, must be made. A portion of this can also be covered using CPF funds.

- Completion Payment & Closing Costs: The remaining costs of the condo, alongside closing costs, are settled to complete the purchase. Closing Costs: These include legal fees, agent fees, stamp duty, and any additional taxes or charges that might apply depending on the transaction specifics. It’s important to note that for resale condos, the buyer is responsible for these costs, while in new launches, some of these fees are covered by the developer.

Understanding the payment schedule and related costs is essential when considering buying a condominium in Singapore. Whether it’s a new launch or a resale property, careful financial planning and budgeting can help you make an informed decision and avoid any delays or surprises during the transaction process. Additionally, seeking advice from trusted professionals such as real estate agents and legal advisors can provide valuable insights and support throughout your home-buying journey. So go ahead and explore your options.

Choosing the Right Condo: New Launch vs. Resale

Now that you understand the payment schedules, the next step is choosing the right condo for you. Are you more inclined toward the flexibility of progressive payments in a new launch, or do you prefer a resale condo’s immediate availability? Explore more condo options and insights in our Explore Condo Page.

For an in-depth breakdown of down payment strategies and considerations, check out our Condo Down Payment Guide to plan your finances effectively.

Steps for Financial Planning

1. Assess Your Financial Situation:

- Calculate Your Net Worth: List your assets (savings, investments, property) and subtract your liabilities (debts, loans). This provides a clear picture of your financial health.

- Review Your Monthly Budget: Evaluate your income and expenses to identify areas where you can save more. Tools like Excel spreadsheets or budgeting apps can be invaluable. 2. Save for the Down Payment:

- Set a Saving Goal: Determine the amount you need for the down payment and set a realistic timeframe to save. If the down payment is 20% of a property worth S$1,000,000, you need to save S$200,000.

- Automate Your Savings: Set up automatic transfers to a dedicated savings account each month. This helps to accumulate funds consistently without manual intervention.

- Cut Unnecessary Expenses: Eliminate or reduce discretionary spending such as dining out, gadgets, and entertainment. Redirect these savings to your down payment fund. 3. Improve Your Credit Score:

- Pay Bills on Time: To build a positive payment history, ensure all your bills and debts are paid punctually.

- Reduce Outstanding Debt: Pay down existing loans and credit card balances to improve your debt-to-income ratio.

- Avoid New Debt: Refrain from taking new loans or credit cards before applying for a mortgage. 4. Consult with Financial Advisors:

- Professional Financial Advice: Certified financial advisors can provide personalised advice tailored to your financial situation and goals.

- Mortgage Brokers: These specialists can guide you through the loan options, helping you find competitive rates and favourable terms. 5. Loan Application Process:

- Secure Pre-Approval: Obtain a mortgage pre-approval from banks or financial institutions. This helps you understand how much you can borrow and signals to sellers that you are a serious buyer.

- Compare Loan Packages: Evaluate different mortgage packages from various banks. Pay attention to the interest rates, lock-in periods, and repayment flexibility.

- Prepare Documentation: Gather necessary documents such as payslips, CPF statements, tax returns, and identification documents. Having these readily available can expedite the loan approval process. 6. Plan for Additional Costs:

- Buffer for Miscellaneous Expenses: Set aside a buffer fund to cover unexpected expenses such as repairs, renovations, and moving costs.

- Evaluate Insurance Needs: Consider purchasing mortgage insurance to protect your investment and family in case of unforeseen circumstances.

By following these financial planning steps, you can streamline your journey towards owning a condominium in Singapore. Through diligent saving, smart budgeting, and seeking professional guidance, you can confidently navigate the complexities of the home-buying process.

Highlighting the Key Differences

While both new launch and resale condos ultimately lead you to homeownership, their payment schedules differ significantly, especially in terms of the stages involved, timelines, and costs. A comparative table or an infographic can effectively highlight these differences, allowing you to visualize which pathway may suit your financial planning better.

Planning & Preparing for Your Condo Purchase

Understanding your condo’s payment schedule is key to effective financial planning. It allows you to calculate the total purchasing costs, prepare for upcoming payments, and secure financing if needed. With this knowledge, aspiring condo owners can confidently take steps towards securing their future home, possibly consulting a financial advisor for tailored advice.

Conclusion

Whether you opt for the excitement of a new launch condo with its progressive payment structure or the immediacy of a resale condo, understanding the detailed payment schedules is essential. This knowledge not only aids in transparent financial planning but also ensures a smooth and secure condominium buying experience in Singapore. By taking into account the different structures for new launches and resale condos, you’re well-prepared to make informed decisions in Singapore’s dynamic real estate landscape.