Estate planning is one of those critical concerns that remain paramount for anyone who has property under their name. In Singapore, where property is the most obvious investment, and inheritance laws may not be the most straightforward things to deal with, the need for a disciplined and organized way to pass on your real estate is quite apparent.

Here is a novel, underappreciated strategy in buying property under a trust—a structured, cost-effective, and efficient way to undertake estate planning. The comfort of knowing how to integrate trusts into your financial portfolio will ensure it is a comprehensive tool to manage your today while at the same time making certain your assets are smoothly transitioned to your family tomorrow. In our comprehensive exploration of the matter, we shall explain the benefits and processes in store for one buying property under a trust in Singapore.

We will take real property investors, young families, and financial planners through a very easy way of estate planning that maximizes control, minimizes taxes, and protects assets.

What is a Trust and How Does it Work for Property Ownership?

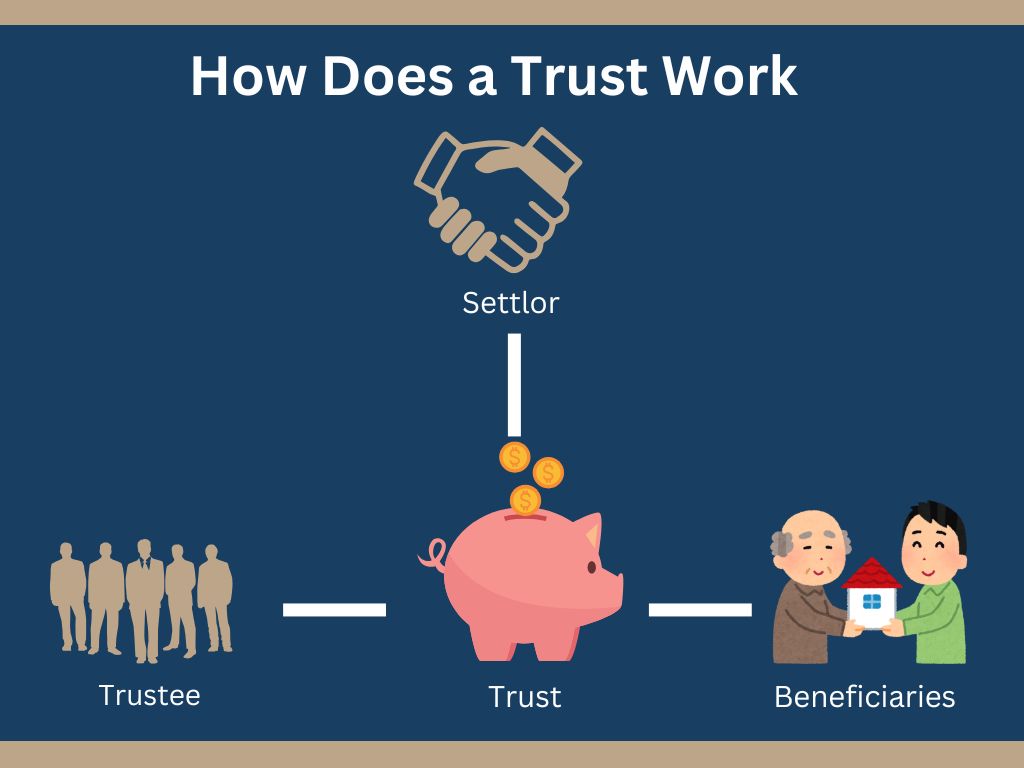

A trust is a legal arrangement that separates the legal ownership of assets from the beneficial ownership of those assets. The asset is entrusted to a trustee, who is appointed by the owner for the benefit of others, called the beneficiaries. The person who creates the trust is the settlor.

In the case of owning a property in Singapore, a trust can be a paradigm of simplicity and expediency in estate planning. A trust usually eliminates the necessity for public courts, thus saving the time-consuming and potentially expensive process of probate. The result is a direct and swift transfer of asset ownership according to the clear directives set within the trust’s deed.

Why Should One Purchase Property in a Trust?

Buying property in trust in Singapore: this would be a strategic option for someone who would like to clean up their estate management and protect their assets for their lineage. Here are some reasons one should consider setting up a trust to buy properties:

Avoiding Probate:

The assets under trust are transferred to the beneficiaries without the hassle, delay, and cost of probate following the death of the settlor. This is even more applicable in Singapore, where the probate process can be quite expensive and long.

Proper Estate Planning:

A well-structured trust leads to a transparent and enforceable document governing the administration and distribution of assets, thus avoiding disputes in the family following the death of the settlor.

Protection of Assets:

The property does not form part of the personal estate of the settlor. During bankruptcy or lawsuit challenges, for example, the assets in the trust fund are generally protected against personal creditors.

Control Over the Assets:

A settlor may indicate terms in the trust deed as to distribution of benefits, how and when it will be received, thereby exercising some form of control, even in death. This is most important when the settlor has minors or beneficiaries who are not financially prudent.

Tax Planning:

Although Singapore does not have estate duties or inheritance tax, there are other tax considerations in which trusts can be valuable; for instance, it may provide a more favorable tax treatment on the rental income that the property generates.

Buying property in Singapore, including a trust within your estate planning, has potential for further improvement in the level of control you have over your assets, as well as the surety that they are passed on in line with your wishes. It is a way of not only securing your financial legacy but also keeping one’s mind at peace that your estate is well arranged, and your loved ones are taken care of.

Disadvantages of Buying Property Under Trust

While the benefits are substantial, there are considerations to be mindful of when choosing to purchase property under a trust.

Less Immediate Access to Assets

Once placed in trust, property may only be accessed according to the terms established by the settlor, which could limit its use in immediate or emergency situations.

Trust Management Fees

Depending on the specifics of the trust, there may be management fees associated with oversight and administration that should be factored into the overall financial planning.

Trust Administration Complexity

Trust administration, when not understood or organized correctly, can be complex. It’s essential to have a clear strategy and qualified individuals managing the trust to ensure it operates as desired.

Additional Considerations for Singapore

In Singapore, the intricate web of estate laws and regulations emphasizes the importance of making informed decisions regarding your property planning. Several specific nuances apply, which we explore here.

Tax Implications

Singapore’s tax framework may be affected by the use of a trust for property ownership, and the financial implications can be significant. Engaging with a tax advisor who understands the interplay of trust law and tax can provide useful insights.

CPF Usage

The Central Provident Fund (CPF) is a unique retirement savings and insurance scheme integral to Singapore’s social security system. When considering the use of CPF funds for a property purchase under a trust, be sure to review current regulations and policies.

To know more about CPF in detail view our glossary page.

The Role of the Trustee

Selecting a trustee is a matter of trust – quite literally. The trustee plays a pivotal and ongoing role in upholding the integrity of the trust, making a careful selection critical. Look for someone or an institution with a proven track record, financial acumen, and a clear understanding of their fiduciary duties.

Setting Up a Trust in Singapore

The process of establishing a trust in Singapore is not overly complex but it does necessitate a thoughtful approach. Engage with legal experts well-versed in the nuances of Singapore’s trust legislation to singapore-guide you through its creation.

Drafting a Trust Deed

The trust deed is the foundational document that articulates the terms and conditions by which the trust will operate. It should be comprehensively and meticulously written to ensure it aligns with your intentions and stands up to legal scrutiny.

Is buying property in a trust structure right for me?

The decision to purchase property under a trust is ultimately a personal one, dependent on individual circumstances and objectives. However, for those seeking a streamlined and efficient approach to estate planning in Singapore, leveraging the benefits of a trust can be highly advantageous.

If you are considering this option, it is essential to consult with financial planners, legal advisors, and tax experts to fully understand the implications and make informed decisions. With careful planning, a trust for property ownership can help fulfill your long-term goals while providing peace of mind for you and your loved ones. So be sure to do thorough research and consult with professionals before making any significant decisions about property ownership under a trust in Singapore.

Overall, the use of a trust structure offers flexibility, control, and protection for your assets, making it a valuable tool in estate planning. So take the time to explore this option and see if it aligns with your personal goals and objectives. With proper guidance and planning, you can create a comprehensive estate plan that ensures your wishes are carried out efficiently and effectively. So consider incorporating a trust structure into your property ownership plans and reap the benefits of this strategic approach.

Therefore, despite some potential drawbacks and complexities, using a trust for property ownership in Singapore can be a wise choice for those looking to secure their assets and ensure their legacy for future generations. It is a powerful tool that offers numerous advantages and can help you achieve your long-term financial goals.

Conclusion

Property ownership under a trust can be a pivotal and powerful strategy in Singapore. It streamlines the inheritance process, offers considerable control over the distribution of assets, and can protect properties from certain liabilities.

While the potential advantages are clear, it is equally vital to recognize that trusts are not one-size-fits-all solutions. Each trust must be crafted with precision to reflect an individual’s unique circumstances, goals, and assets. Professional guidance is indispensable, underscoring the need to work closely with legal and financial experts well-versed in the complex web of estate and property laws in Singapore.

The key to effective estate planning is not just in the tools you select, but in how well they are utilized and integrated into your broader financial strategy. In exploring the potential of trusts for property ownership, one can pave the way for a more organized and efficient transfer of wealth and a more secure future for loved ones.

Make it a priority to investigate the options available to you and initiate necessary conversations with trusted professionals. Only through informed decisions and meticulous preparation can you ensure that the fruits of your labor will continue to bear dividends for generations to come in the Lion City.