Buying a property is a monumental milestone, signifying the achievement of a major life goal and often signaling a significant investment in your future. However, the joy of ownership usually comes with financial responsibilities, and in Singapore, Buyer’s Stamp Duty (BSD) is one such obligation that every property buyer must understand and prepare for.

In a city-state renowned for its robust real estate market and government measures to ensure its stability and accessibility, understanding the intricacies of BSD is vital for Singaporeans considering property ownership. From its definition to the nitty-gritty of calculating this duty, this comprehensive singapore-guide is designed to empower potential property purchasers with the knowledge they need to make informed decisions and prepare financially.

What is Buyer’s Stamp Duty (BSD)?

Upon the transfer of property ownership, the Singaporean government imposes a tax called the Buyer’s Stamp Duty (BSD). This tax applies to documents executed for the sale and purchase of property and is an essential aspect of real estate transactions in the country. BSD is a tiered tax, meaning it increases along with the higher purchase price of the property, following specified rate bands.

However, understanding BSD goes beyond knowing that it’s a cost incurred during property transfer. This tax affects the upfront cost of buying a property and, consequently, the affordability of the overall purchase.

Who Needs to Pay Buyer’s Stamp Duty?

In most cases, the responsibility to pay BSD falls upon the buyer of the property. The BSD amount is an immediate financial consideration that buyers must factor into their budget. Exceptions to this rule exist, though they are rare and usually pertain to niche types of transactions or extenuating circumstances. It is prudent for buyers to ensure that the BSD payment is included in the settlement, lest they encounter legal or financial hiccups down the line.

How Much is Buyer’s Stamp Duty in Singapore on Property?

How can potential buyers quantify their stamp duty obligation? The answer lies in the tiered rates set by the Inland Revenue Authority of Singapore (IRAS) for residential and non-residential properties. Property value determines the rate at which BSD is levied, and this structure aims to adjust the tax liability to the financial means of the buyer and the type of property being acquired. For first-time homebuyers or those seeking HDBs, there are special considerations that could potentially lessen their BSD burden.

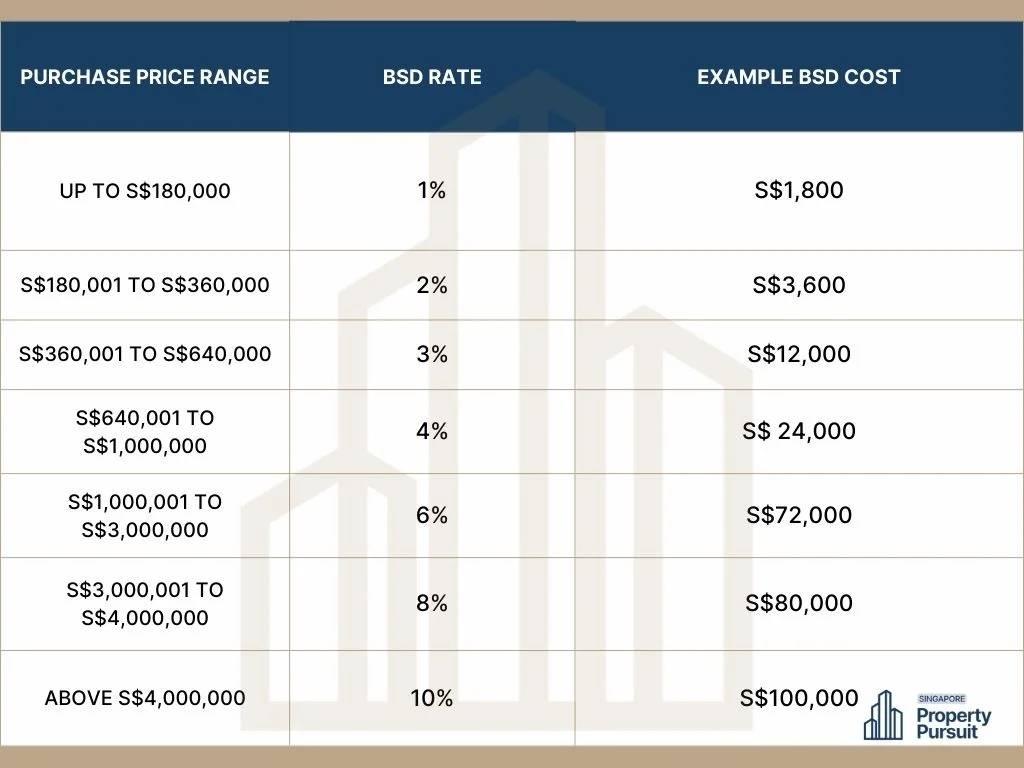

Buyer’s Stamp Duty Rates for Residential Properties (Current as of April 2024)

The current rates for residential property are straightforward and tiered. The following table denotes the rates for various purchase price ranges, helping buyers estimate their stamp duty costs with ease.

Note: The purchase price denotes the actual price stated in the purchase document, regardless of whether this matches the market valuation.

How to Calculate Buyer’s Stamp Duty in Singapore

To calculate your specific stamp duty, you should consider the higher value between the purchase price and the market value of the property. Apply the rate relevant to the price range in which this higher value falls. Here’s a simplified formula for calculations:

BSD = Purchase Price/Market Value (whichever is higher) x Rate`

Or, at the very bottom of our hearts, Use the following computation to calculate the tax for a condo priced at S$1,200,000:

Market Value = $1,200,000

BSD = $1,200,000 x 6%

BSD = $72,000

Does Buyer’s Stamp Duty Apply to All Property Purchases?

While it’s a general rule that BSD applies to all property purchases in Singapore, there are some exemptions such as for first-time homebuyers acquiring a property under specific schemes. Likewise, the Additional Buyer’s Stamp Duty (ABSD) is an additional tax levied on top of the standard stamp duty rate and applies to specific cases such as additional homes or non-Singaporean citizens.

Understanding Additional Buyer’s Stamp Duty (ABSD) and Its Relationship with BSD

The Additional Buyer’s Stamp Duty (ABSD) in Singapore serves as another layer of tax on top of the standard Buyer’s Stamp Duty (BSD). Implemented to cool the residential property market and discourage speculative buying, ABSD targets certain groups of buyers, such as those purchasing their second or subsequent property, and foreigners buying any property in Singapore. The rationale behind ABSD is to ensure a stable and sustainable property market, making housing more accessible to first-time buyers and permanent residents.

ABSD rates vary depending on the buyer’s citizenship, residency status, and the number of properties already owned. For example, Singapore citizens are required to pay ABSD for their second and subsequent property purchases, with the rates increasing progressively. In contrast, foreigners and entities such as corporations are subject to ABSD on their first property purchase onwards.The Additional Buyer’s Stamp Duty (ABSD) in Singapore serves as another layer of tax on top of the standard Buyer’s Stamp Duty (BSD). Implemented to cool the residential property market and discourage speculative buying, ABSD targets certain groups of buyers, such as those purchasing their second or subsequent property, and foreigners buying any property in Singapore. The rationale behind ABSD is to ensure a stable and sustainable property market, making housing more accessible to first-time buyers and Singapore permanent residents.

ABSD rates vary depending on the buyer’s citizenship, residency status, and the number of properties already owned. For example, Singapore citizens are required to pay ABSD for their second and subsequent property purchases, with the rates increasing progressively. In contrast, foreigners and entities such as corporations are subject to ABSD on their first property purchased onwards. The total stamp duty, including both ABSD and BSD, is calculated based on the property’s purchase price or market value, whichever is higher, and must be paid within 14 days of the documents signed for the property transaction.

The relationship between ABSD and BSD is straightforward yet significant. While BSD is mandatory for all property transactions and is calculated based on the purchase price or market value of the property (whichever is higher), ABSD is an additional tax that applies under specific circumstances. Essentially, ABSD is supplementary to BSD and is part of the government’s measures to regulate the real estate market dynamics, preventing excessive investment-driven demand and maintaining affordability for genuine homeowners.

Understanding Buyer’s Stamp Duty (BSD) When Upgrading from HDB to a Condo

When upgrading from an HDB flat to a private condo, many buyers focus on financing and CPF usage, but it’s also crucial to factor in Buyer’s Stamp Duty (BSD). BSD applies to all property purchases in Singapore and is calculated based on the purchase price or market valuation—whichever is higher.

If you’re still holding on to your HDB while purchasing a condo, you might also be subject to Additional Buyer’s Stamp Duty (ABSD). Understanding these stamp duty costs upfront can help you budget more effectively for your upgrade.

Read more: Buyer’s Stamp Duty: How Much Will You Pay?

Additional Resources for Buyer’s Stamp Duty in Singapore

For those looking for further guidance or calculation precision, Singapore offers a wealth of resources at your disposal. The official government website provides comprehensive information on all aspects of BSD, as well as online calculators to assist in precise tax estimations. Seeking consultation with a tax professional remains an excellent option for those with complex or individualized tax situations.

Conclusion

Buyer’s Stamp Duty is an integral part of the property transaction process in Singapore. It affects both the cash flow and the overall purchase price of property acquisitions. Familiarizing oneself with the BSD structure and related taxes can provide immense peace of mind and financial prudence for potential property buyers in Singapore. Understanding the intricacies of this tax, including rates and potential exemptions, is crucial for a smooth and informed real estate investment experience.