The distinction between freehold and leasehold properties is crucial for anyone venturing into the complex world of real estate purchasing or investment. It dictates the nature and duration of your ownership and has significant implications for your financial portfolio. In this in-depth exploration, we unravel the intricacies of freehold and leasehold properties, focusing on cost, and ownership nuances—by the end, you will be well-versed to make informed decisions about your real estate ventures.

What is Freehold and Leasehold Property?

Before you can appreciate the differences in cost and ownership, it is paramount to grasp the fundamental concepts.

Freehold Ownership

Freehold property grants the owner absolute rights over both the land and any property built upon it for an indefinite period. This type of ownership is often perceived as a secure, long-term investment due to the perpetual nature of land ownership. It’s a straightforward model that doesn’t involve ground rent or lease expiration, giving owners full control over their holdings.

Leasehold Ownership

Leasehold properties, in sharp contrast, allow the owner to hold the property for a fixed term, subject to the lease agreement with the freeholder who maintains ownership of the land. In Singapore, typical lease durations range from 99 years to a substantial 999 years. This setup necessitates careful consideration of the remaining term and potential extension clauses.

To take an example, a leasehold property with a remaining lease of 60 years might be more affordable initially than its freehold counterpart, but it also signals a finite ownership period, which can affect the resale value and inheritance planning.

Freehold and Leasehold Condos

When deciding between a freehold or leasehold condo, it’s essential to understand the implications on ownership and cost. Freehold and leasehold condos differ significantly in terms of ownership duration and control.

Freehold Condos

Freehold condos offer perpetual ownership of both the unit and the land it sits on, making them a secure and often more desirable investment. This type of ownership appeals to those looking for long-term security and control over their property.

Explore Available Freehold Condos: Looking for a secure, long-term investment in Singapore? Browse Freehold Condos in Singapore to explore premium options.

Leasehold Condos

In contrast, a leasehold condo provides ownership for a set term as defined by the lease agreement, with typical lease durations in Singapore ranging from 99 to 999 years. Leasehold and freehold properties both come with their own set of considerations. Leasehold condos might initially be more affordable, but the concept of lease decay, where the value diminishes as the lease term decreases, can affect long-term investment returns.

Is a 99-Year Leasehold Property Right for You?

✅ More affordable than freehold condos

✅ Often located in prime districts with high rental demand

✅ Suitable for short- to medium-term investments

✅ Potential for high rental yields

However, resale value declines as the lease runs down, which can impact capital appreciation.

Explore 99-Year Leasehold Condos: Looking for an affordable yet strategic investment? Browse 99-Year Leasehold Condos in Singapore.

999-Year Leasehold Properties in Singapore

While often categorized as leasehold, a 999-year leasehold property is sometimes considered “as good as freehold” because of its extended lease duration. These properties are rare and can be a valuable long-term investment for buyers who prefer leasehold properties with little risk of lease decay.

Why Choose a 999-Year Leasehold Property?

✅ Nearly perpetual ownership, similar to freehold

✅ Often found in desirable districts

✅ Stronger long-term value retention compared to 99-year leaseholds

These properties are ideal for those who want the benefits of freehold without the high price tag.

Browse 999-Year Leasehold Condos: Want a long-term investment without the freehold premium? Explore 999-Year Leasehold Condos in Singapore.

Ownership and Investment Implications

Therefore, when evaluating freehold or leasehold property options, potential buyers must weigh the longevity and resale value implications, especially as leasehold properties approach the end of their lease terms. The financial portfolio of freehold property owners and those holding leasehold units will be impacted differently based on the nature of their ownership. Understanding these nuances ensures that you make informed decisions about your real estate ventures.

Cost Considerations

The financial outlay and ongoing expenses associated with freehold and leasehold properties can significantly influence your investment and long-term revenue projections.

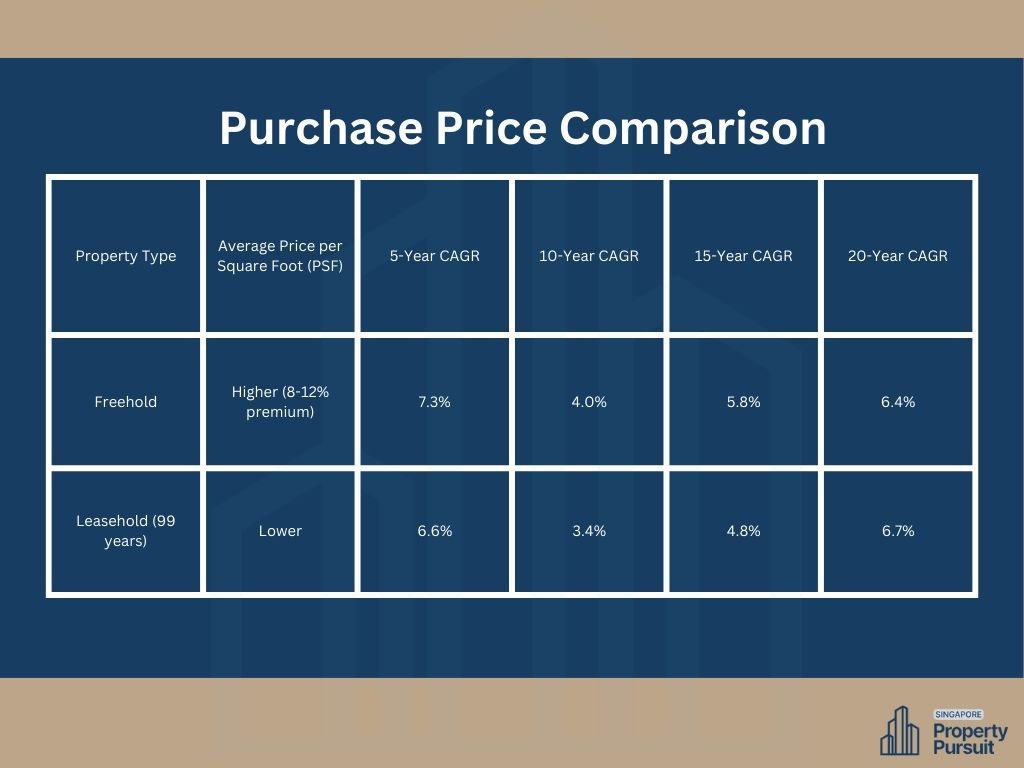

Purchase Price

Freehold properties often command a higher purchase price compared to leasehold properties with similar characteristics. The reason behind this pricing disparity is clear—freehold ownership of land is a scarce and desirable commodity. It’s an asset with long-term capital growth potential, which is reflected in the initial cost.

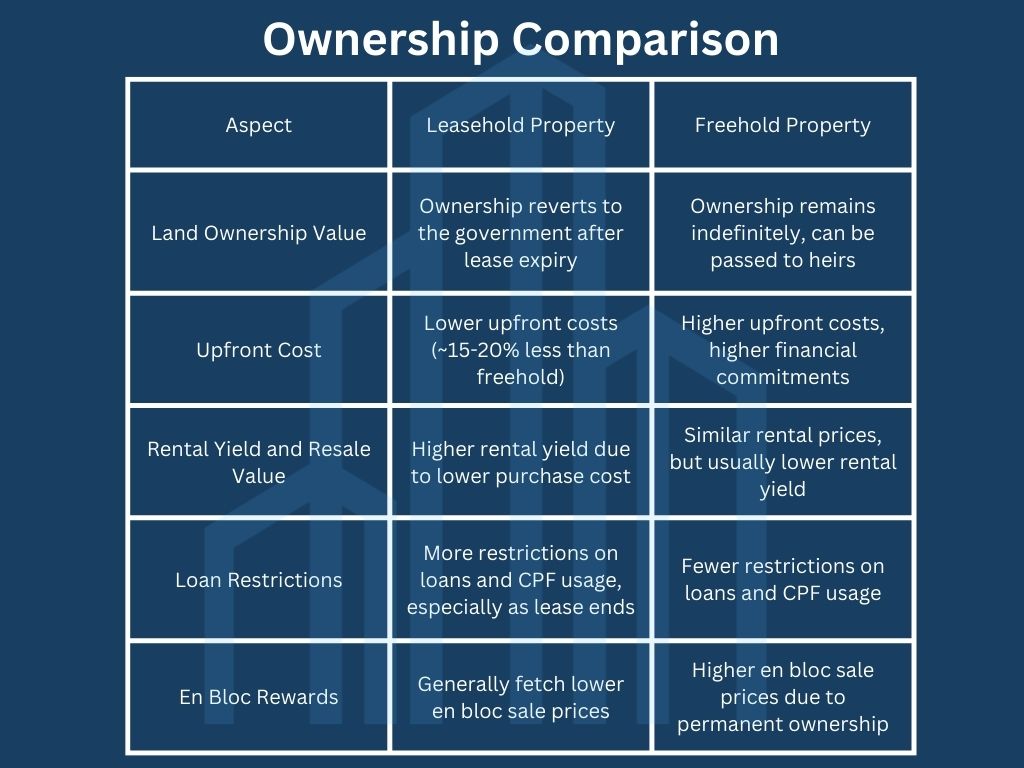

Additionally, when you purchase a freehold property, you are buying both the land and the building, which further justifies the premium price. On the other hand, leasehold properties, being akin to a rental agreement with a time stamp, translate to a cheaper entry point. This can be more appealing to those with limited capital for upfront investment or those looking for a shorter-term commitment.

Property Taxes

Both freehold and leasehold properties are subject to property tax based on an annual value, assessed by the Inland Revenue Authority of Singapore (IRAS). While this is a recurrent cost that neither ownership model can escape, it’s essential to note that freehold property taxes might incrementally rise with property appreciation, which can factor into your long-term financial planning.

Ground Rent (Leasehold Only)

One unique financial aspect of leasehold properties is ground rent. This is an annual fee that leaseholders pay to the freeholder under the terms of the lease. The quantum of ground rent can vary from token amounts to substantial figures, depending on the property location and the provisions set in the lease agreement. Although the immediate impact on your pocket might seem nominal, the cumulative effect over the lease period could be substantial, particularly for higher-value properties.

Financing

How you structure the financing for your property purchase also differs between freehold and leasehold properties. Banks, for instance, may offer longer loan tenures for freehold properties as the ownership model implies a perpetual asset. This aligns with the repayment profile you’d typically associate with a long-term investment. For leasehold properties, the loan tenure reflects the remaining lease term, often resulting in higher monthly instalments or an accelerated repayment schedule.

It’s advisable to talk to several banks or financial advisors to understand the implications on your loan quantum, interest rates, and the different financing options available for each ownership type.

Ownership Rights and Considerations

Beyond the monetary engagement, the most significant distinction between freehold and leasehold properties lies in the realm of ownership flexibility and control.

Ownership Duration

Freehold ownership is timeless, akin to an heirloom that can be passed down through generations. This permanence is a powerful aspect for those looking to establish a lasting legacy or secure inheritance of the property. In contrast, leasehold ownership, bound by the lease period, poses a greater degree of uncertainty and requires proactive management, especially concerning the renewal of increasingly shorter leases.

Renovation Freedom

Freehold owners enjoy complete autonomy in modifying their properties, limited only by local council regulations and building laws. Leaseholders, however, need to negotiate any substantial structural changes with the freeholder, who might have strict criteria within the lease agreement, safeguarding their interest in maintaining property standards.

The renovation freedom could tilt the scale for professionals who need the liberty to modify their working space or families who foresee extensive changes to accommodate their lifestyle.

Inheritance

A key consideration for estate planning is the transfer of property to beneficiaries. With freehold properties, the full asset can be bequeathed without the burden of lease terms affecting the inheritance process. For leasehold properties, the remaining lease term and the stipulations around lease extensions or whether the lease is restructured into a purchase, become significant determinants of the property’s value to the heirs.

This brings forth the necessity for a strategic estate plan that anticipates the impact of leasehold property on your legacy.

Weighing the Costs and Ownership Advantages

As you contemplate the right investment for your situation, it’s crucial to weigh the financial implications and the ownership advantages that come with both freehold and leasehold properties. There is no one-size-fits-all answer; rather, your individual needs, budget, and investment horizon should singapore-guide the decision-making process.

Freehold Properties:

- Long-term investment is suitable for those looking to preserve and grow wealth over generations.

- Higher entry prices are balanced by the potential for increased asset value and flexibility in ownership.

Leasehold Properties:

- More affordable initial investment, making home ownership accessible to a broader market.

- Potential for higher yields in the short to medium term for investors.

- Required awareness and management of lease terms and renewal conditions to safeguard long-term interests.

Which Is Better?

The eternally popular question—’ Which is the superior option?’ The answer lies within the contours of your unique circumstances. If you’re looking for a property to grow with you and endure beyond your lifetime, freehold is an obvious contender. On the other hand, leasehold properties offer a stepping stone into real estate ownership, with potential for profitability, especially in a market like Singapore.

Conclusion

Understanding the intricate dynamics of property ownership is imperative as you step into the world of real estate. Whether you’re a first-time homebuyer, a seasoned property manager, or a savvy investor, the choice between freehold and leasehold properties dictates a plethora of considerations—from initial costs and ongoing tax implications to the implications for renovation and inheritance. This article serves as a comprehensive primer for your real estate forays, but remember, personalized financial advice and a deep market understanding are invaluable tools as you make these monumental decisions that will shape your future wealth.

Related Insights:

Should You Consider an Executive Condo?

When choosing between freehold and leasehold properties, Executive Condominiums (ECs) offer a unique alternative. They start as subsidized housing but become fully privatized after 10 years, often providing better value than private condos. Could an EC be a better option for you?

Read more: Executive Condos: A Smart Alternative to Private Condos?

How Property Type Affects Tenure Choices

While the freehold vs. leasehold debate is crucial, property type also plays a big role in tenure restrictions. Some properties, like HDB flats and Executive Condos (ECs), are strictly leasehold, while others, like landed homes, can be freehold. Understanding property types helps you align your investment with your long-term goals.

Read more: Property Types in Singapore: What You Need to Know