Strategically placed at the heart of real estate’s financial architecture, the Progressive Payment Scheme (PPS) in Singapore is a unique funding framework that serves as a foundational reservoir of potential for both investors and homebuyers. With its deft balance of low initial commitments and milestone-based disbursements, PPS offers a fresh paradigm in the acquisition of new launch condos, and understanding its contours is vital for those navigating the bustling real estate market in Singapore. In this comprehensive singapore-guide, we unpick PPS to prepare you to make informed choices that resonate with your investment goals and financial health.

What is the Progressive Payment Scheme (PPS)?

In essence, the Progressive Payment Scheme (PPS) is an alternative payment scheme for the purchase of properties under construction. Unlike the traditional Payment Scheme, where the purchase price is paid in full upon the signing of the Sale & Purchase Agreement (S&P), the PPS allows you to pay for your property gradually as it reaches key stages of construction. This not only lightens your initial financial burden but also ensures greater transparency and accountability in the payment process, closely tying your financial outlays with the developmental progress of your property.

Understanding the Basics

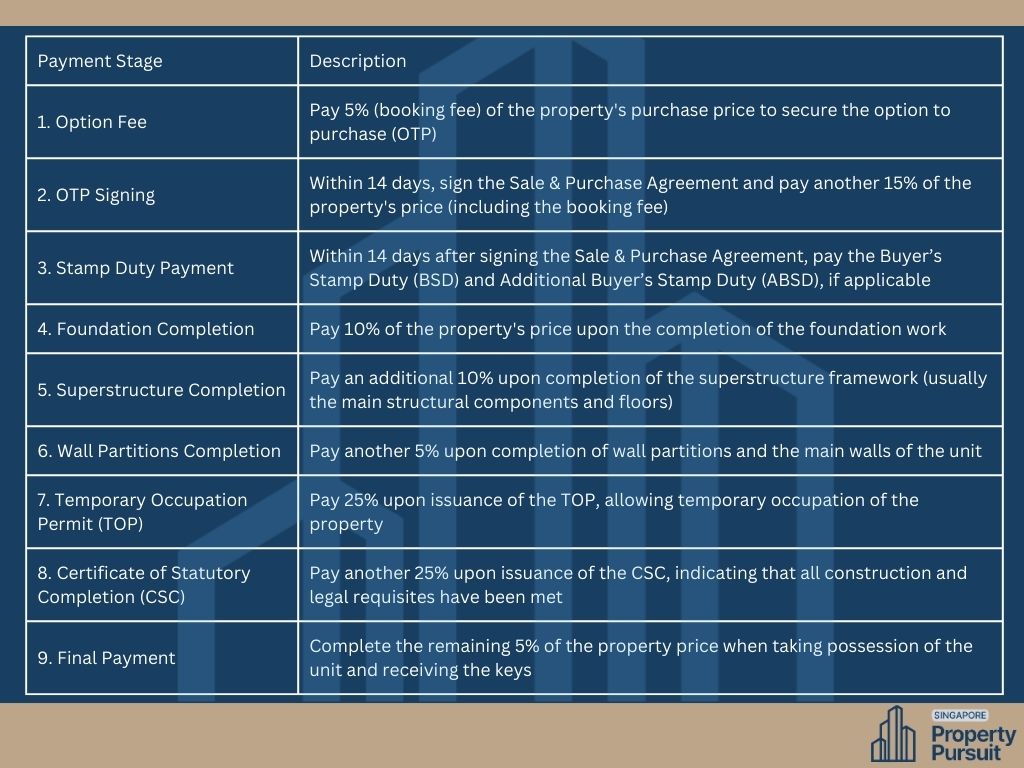

The PPS is structured such that payments are typically divided into 10 to 12 stages representing different phases of property construction. You will make these payments in line with the milestones, beginning with a downpayment upon the signing of the S&P, and concluding with the final disbursement upon obtaining your property, typically after the issuance of the Certificate of Statutory Completion or Temporary Occupation Permit (TOP).

Key Acronyms and Terms

It is essential to familiarize yourself with common acronyms and terms related to the PPS to converse fluently in the language of property transactions. These include:

- S&P: Sale & Purchase Agreement – The contract that outlines the terms of purchase between buyer and developer.

- CSC/TOP: Certificate of Statutory Completion/Temporary Occupation Permit – Marks the property’s functional status and legal occupation date.

Explore Singapore Condos with PPS

If you’re considering purchasing a new launch condo using the Progressive Payment Scheme, it’s important to explore available options that align with your budget and investment strategy.

Discover top Singapore condos under construction and their PPS eligibility by visiting our condo listings, where you can browse projects and compare financing structures tailored to your needs.

Benefits of Using PPS for Your New Condo Purchase

Navigating a complex financial landscape requires a clear understanding of the benefits associated with each payment option. PPS offers several distinct advantages:

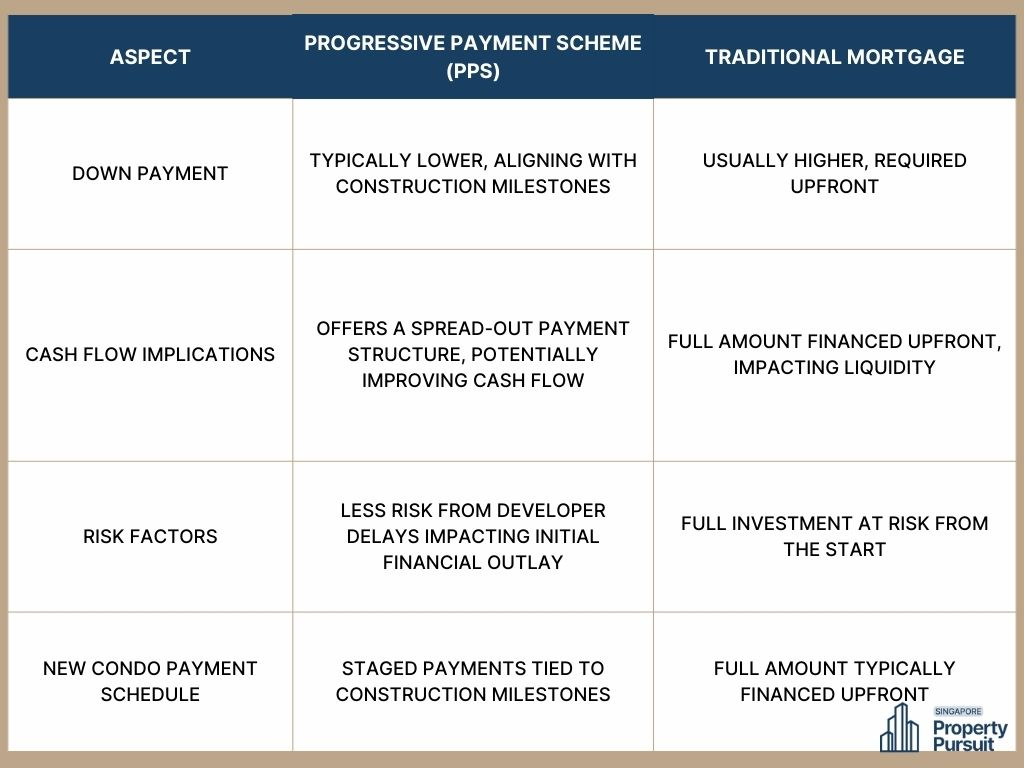

Lower Initial Investment

The requirement for an initial downpayment under PPS is traditionally lower compared to a standard mortgage. This can be a pivotal feature for individuals looking to conserve capital, use option cash, or spread their investment risk across different assets.

Aligned with Construction Milestones

Your payments are tied to tangible stages of development, such as the installation of window frames or other significant construction milestones. This ensures that you are paying for progress and that the developer must demonstrate completion of work to receive payments, promoting a sense of accountability and diligence.

Protection from Unforeseen Delays

In the event of construction delays, the payment milestones under PPS often shift accordingly. This provides a degree of financial protection, minimizing any potential escalation in costs that might occur with a rigid payment plan.

Potential Capital Appreciation

Investing in a property under construction can offer potential capital appreciation by the time the development is completed. This is especially beneficial when comparing with the immediate purchase of a resale condo.

Legal Fees

Another consideration when utilizing the PPS is the potential savings on legal fees, as the staged payments and clear milestones may reduce the complexity and frequency of legal consultations required throughout the construction period.

Upgrading from HDB? How the Progressive Payment Scheme Affects You

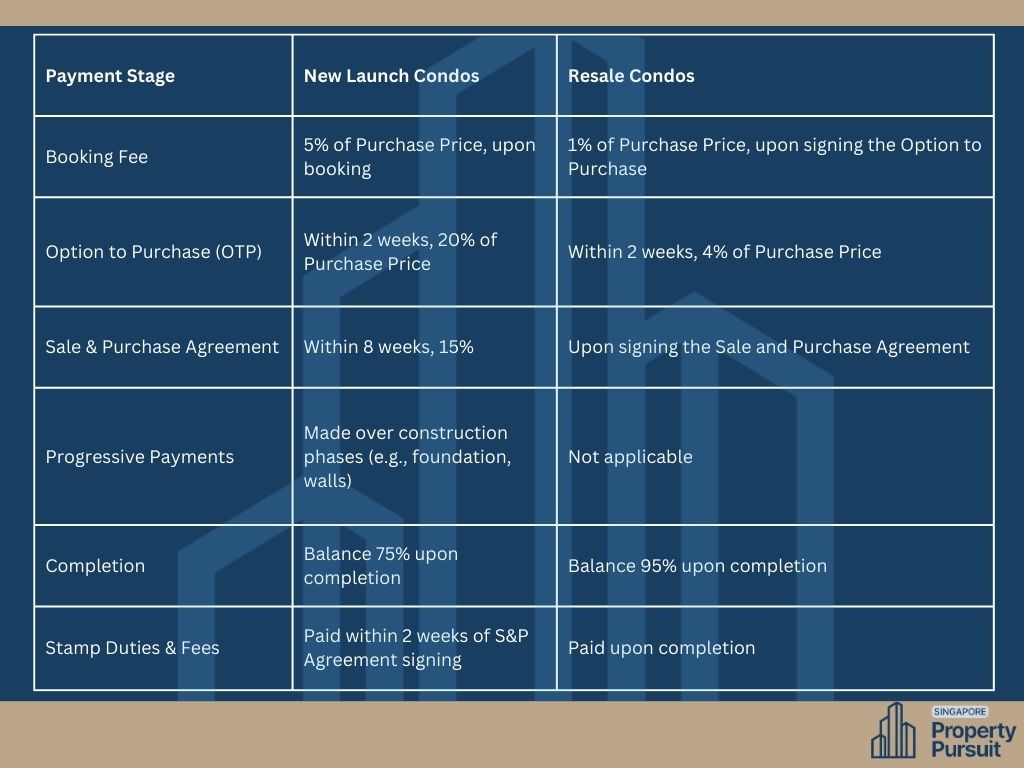

If you’re upgrading from an HDB flat to a private condo, it’s essential to understand how the Progressive Payment Scheme (PPS) works. Unlike HDB purchases, where payments follow a straightforward schedule, PPS allows you to pay in stages as the condo is built, making it easier to manage cash flow.

However, if you’re still servicing an existing HDB loan, you’ll need to factor in loan eligibility, CPF refunds, and stamp duties before committing to a new property. Proper financial planning ensures a smooth transition from HDB to a private condo.

Read more: Upgrading from HDB to a Condo: What You Need to Know

Understanding the PPS Payment Schedule

Every Singapore condo development may have a unique PPS payment schedule, but the structure typically follows a convention. A developer might require a buyer to make a payment upon completion of the foundation (approximately 10% of the purchase price), another upon the completion of the walls and roof (roughly 15%), a third upon the completion of internal works (20-25%), and so forth.

Anatomy of a Payment Schedule

The payment schedule under PPS is constructed to reflect key stages of development and may vary in detail from one development to another. It forms a contractual agreement between the buyer and the developer, compelling both parties to adhere to precise timelines and quality assurance benchmarks.

Flexibility in Motion

It is crucial to be aware that this schedule is not static. It can be adjusted with the mutual agreement of the buyer and developer, ensuring that as plans evolve, so do the payment obligations, preserving an equitable transaction landscape.

Calculating PPS Payments: An Example

To demystify the process, let’s walk through a hypothetical scenario of calculating PPS payments for a new launch condo.

Step One: Information Gathering

You need the following details:

- The purchase price of the condo

- Estimated percentages and stages of construction for the PPS schedule

Step Two: Applying the Percentages

Taking the estimated percentages for each stage, you would apply them to the purchase price to derive the payment amounts. For instance, if the purchase price is SGD 1,000,000 and the PPS requires a 10% payment upon foundation completion, you would calculate 10% of the purchase price (SGD 100,000).

Step Three: Estimating the Total Outlay

By summing the payments calculated for each stage, you can estimate the total amount you will pay under the PPS, providing a robust financial projection for your investment.

Important Considerations When Using PPS

While the PPS is adept at catering to the financial preferences of many buyers, it’s imperative to approach this scheme with a complete understanding of its implications.

Financing Limitations

Not all financial institutions may be amenable to providing loans for properties purchased under the PPS. This can restrict your options for property financing and necessitate a more in-depth search for institutions that are compatible with this scheme.

Long-Term Financial Planning

PPS requires meticulous long-term financial planning, as your payment milestones might extend over a significant period. This necessitates a keen understanding of your financial standing and an ability to commit to these payments over time.

Take Counsel

Partnering with a knowledgeable real estate agent or financial advisor who specializes in Singapore’s property market can provide invaluable guidance. These professionals can steer you towards developments that align with your objectives and shed light on the intricacies of the PPS for each property.

Is PPS Right for Everyone?

While the Progressive Payment Scheme (PPS) offers several advantages, it’s important to consider its potential drawbacks to ascertain whether it aligns with your financial situation and goals. Some considerations include:

- Financing Limitations: PPS might not be suitable for buyers requiring full financing upfront. Since payments are spread out across different construction stages, those needing comprehensive loan coverage from the outset may find PPS limiting.

- Investment Potential: Compared to full upfront payments, PPS could restrict the potential for investment returns. The delayed payment structure means buyers might miss out on the benefits associated with earlier capital investment in other opportunities.

These points underscore the importance of assessing personal financial circumstances and investment strategies when considering PPS for condo purchases.

Comparing PPS with Traditional Mortgages

This table highlights key differences between PPS and traditional mortgages, offering insights into which financial structure may be more beneficial depending on personal circumstances and preferences.

Making an Informed Decision – Is PPS Right for You? (Continued)

In deciding whether PPS is suited to your needs, consider:

- Financial Situation: Assess your current and future financial stability to ensure you can meet the payment milestones.

- Risk Tolerance: PPS may have less immediate financial risk due to developer delays, but consider your overall tolerance for investment and financial risk.

- Investment Goals: Reflect on whether the PPS aligns with your short-term and long-term investment strategies.

- Alternative Financing Options: Explore other financing options for condos, which may have different structures, like balloon payments at the end of the loan term.

Consulting with a financial advisor can provide personalized advice tailored to your specific circumstances. Additionally, considering the role of a condo deposit can help you understand the initial financial commitment involved in reserving a unit during the launch phase.

Resources for Learning More About PPS in Singapore

For further information on the PPS, consider exploring resources from authoritative bodies such as the Urban Redevelopment Authority (URA) of Singapore on Progressive Payment Schemes and other property regulations.

Conclusion

Understanding the nuances of the Progressive Payment Scheme is crucial for making an informed decision. Assessing your financial situation, risk tolerance, and investment goals is essential before committing to this payment structure. Consulting with financial professionals can offer additional insights and guidance, ensuring that your condo purchase aligns with your overall financial strategy.