Myra

Private Condominium

Private Condominium

Units start from S$1760000

Units start from S$1760000

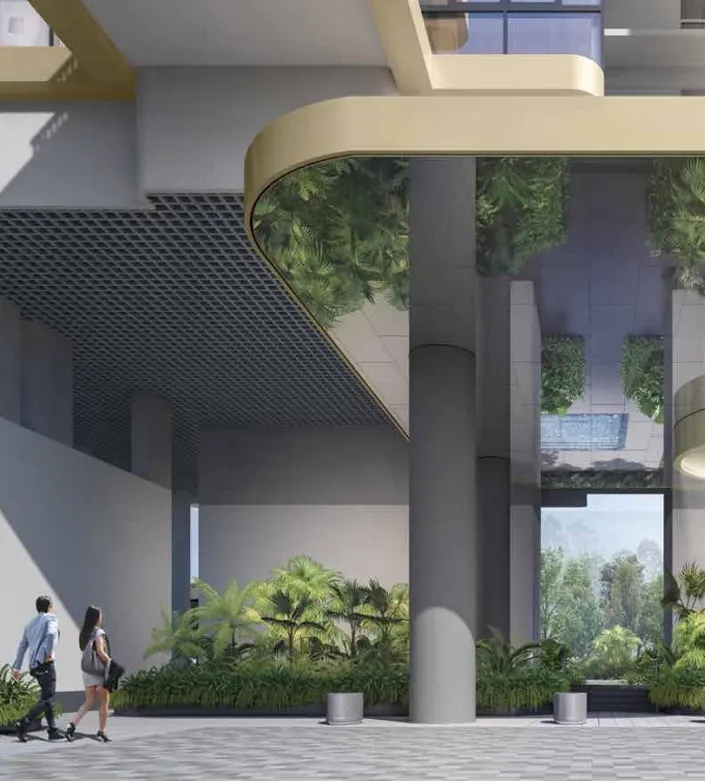

Discover the epitome of modern living at Myra, a freehold condominium development nestled in Toa Payoh, District 13. Completed in 2024, this exclusive development comprises a single block, offering a total of 85 meticulously designed units.

Development Overview:

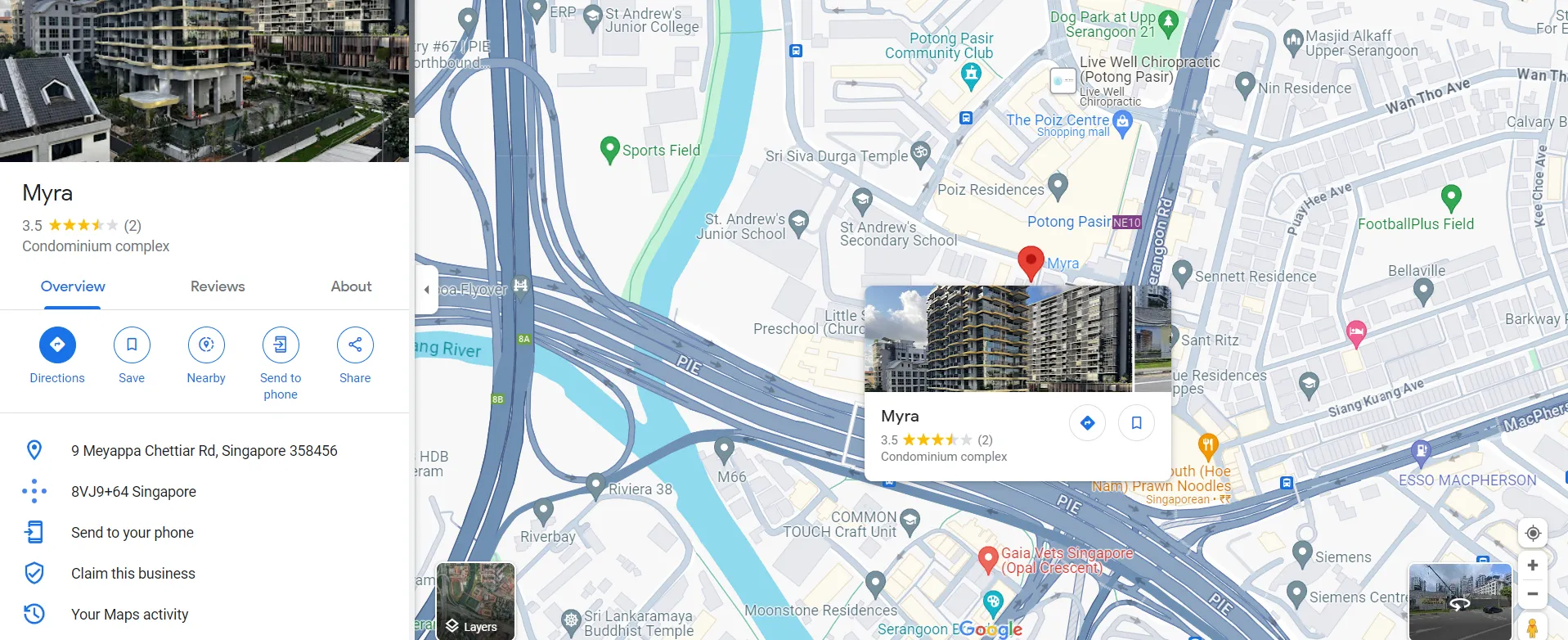

Strategic Location: Myra enjoys a strategic location within walking distance to Potong Pasir MRT, providing residents with easy access to various areas of Singapore, ensuring seamless connectivity and convenience.

Proximity to Schools: For young couples or families with children, Myra is in close proximity to esteemed educational institutions such as Forte Music Training, The Junior Learners Learning Centre (Potong Pasir), and St. Andrew’s Secondary School, creating an ideal environment for academic growth.

Retail Convenience: Residents can meet their grocery and household needs at nearby supermarkets such as FairPrice – Potong Pasir Community Club and Ang Mo Supermarket, ensuring a convenient shopping experience.

Health and Wellness Access: Health services are easily accessible with clinics like Q & M Dental Surgery (POIZ Centre – Potong Pasir), ensuring residents have prompt access to healthcare services.

Monetary Services: Residents can obtain monetary services at POSB – Potong Pasir Branch, adding to the overall convenience of living at Myra.

Leisure and Recreation: For leisure and entertainment, residents can unwind at the nearby park, நொச்சி Nochi, enjoying the fresh air and a serene environment for relaxation.

Transaction History Data: Explore the development’s latest transaction history data, providing residents with transparency and valuable insights into the property.

Key Selling Points:

Meticulously Designed Living Spaces: Myra offers a selection of 85 units, ensuring residents experience thoughtfully designed, modern, and comfortable living spaces.

Proximity to MRT: The development’s close proximity to Potong Pasir MRT ensures convenient and quick access to public transportation, enhancing residents’ mobility.

Educational Hub: Families benefit from the variety of nearby educational institutions, creating an ideal environment for academic growth and development.

Convenient Retail Options: Nearby supermarkets cater to residents’ daily needs, offering a hassle-free shopping experience for groceries and household essentials.

Health and Wellness Access: Myra prioritizes residents’ well-being with nearby healthcare services, ensuring prompt attention to health-related concerns.

Banking Convenience: The presence of POSB – Potong Pasir Branch adds to the convenience, offering residents easy access to monetary services.

Nature Proximity: With the nearby park, நொச்சி Nochi, Myra provides a serene green space for residents to relax, exercise, and enjoy a peaceful natural environment.

Indulge in a harmonious blend of comfort, connectivity, and relaxation at Myra, where every aspect of modern living is meticulously crafted for an ideal and luxurious living experience.

Pricing

Upon the grant of Option to Purchase 5% (Booking Fee)

Upon signing of the Sale & Purchase Agreement or within B weeks from the Option date 20% less Booking Fee

Completion of foundation work 10%

Completion of reinforced concrete framework of unit 10%

Completion of partition walls of unit 5%

Completion of roofing/ceiling of unit 5%

Completion of door sub-frames/ door frames, window frames, electrical wiring, internal plastering and plumbing of unit 5%

Completion of car park, roads and drains serving the housing project 5%

Notice of Vacant Possession (TOP) 25%

On Completion date 15%

Location

Review

👍The good

- Freehold tenure adds long-term value.

- Proximity to Potong Pasir MRT station.

- Amalgamation of 17 land plots for scale.

- Exclusivity with only 85 units.

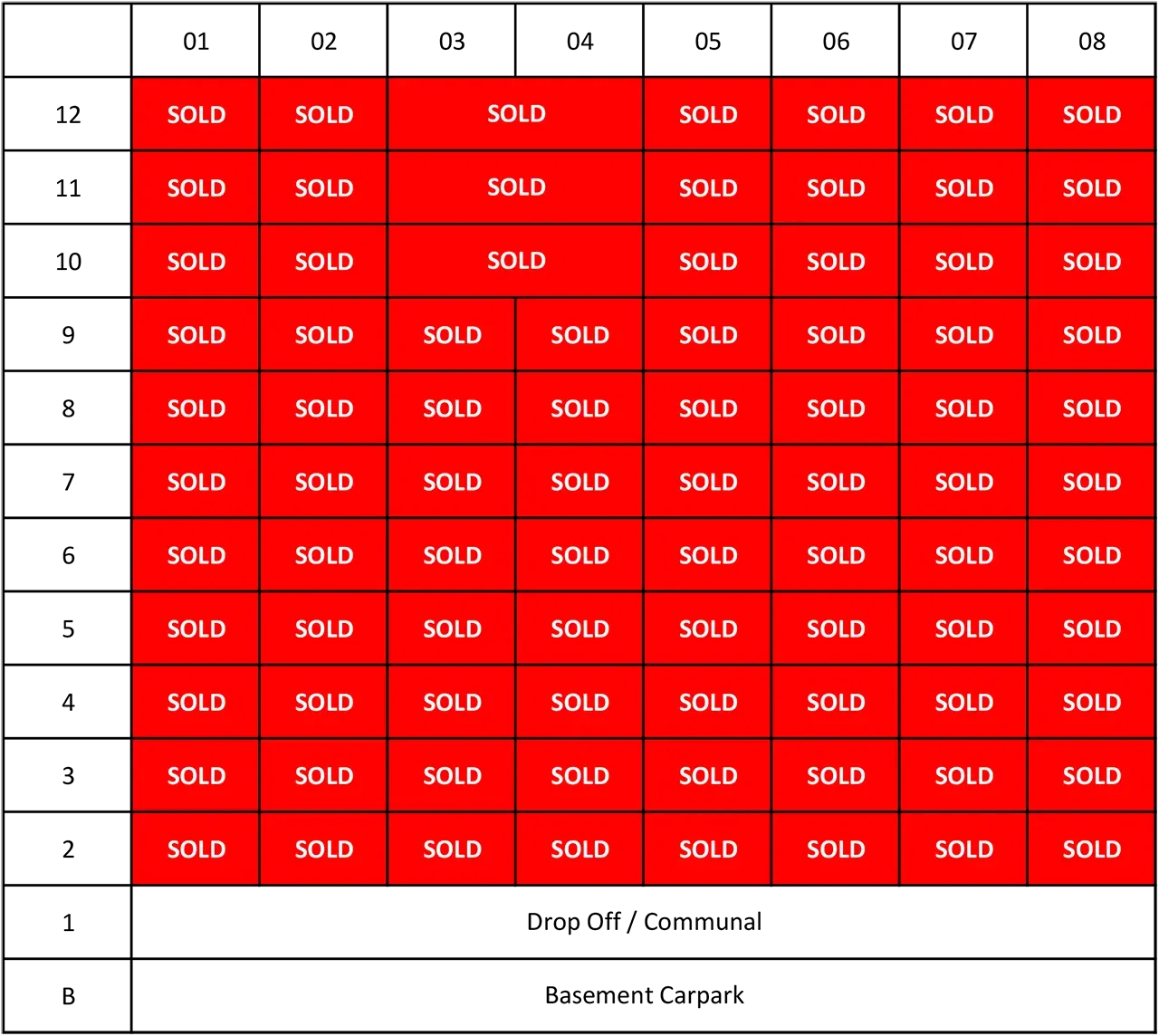

- Strong take-up rate since launch.

- Potential for attractiveness as a rental.

- Integrated development feel.

👎The bad

- The TOP date is still a few years away.

- Relatively higher pricing compared to neighboring projects.

- Pricing may be a concern for potential investors.

- Questions about the pricing gap compared to nearby projects.

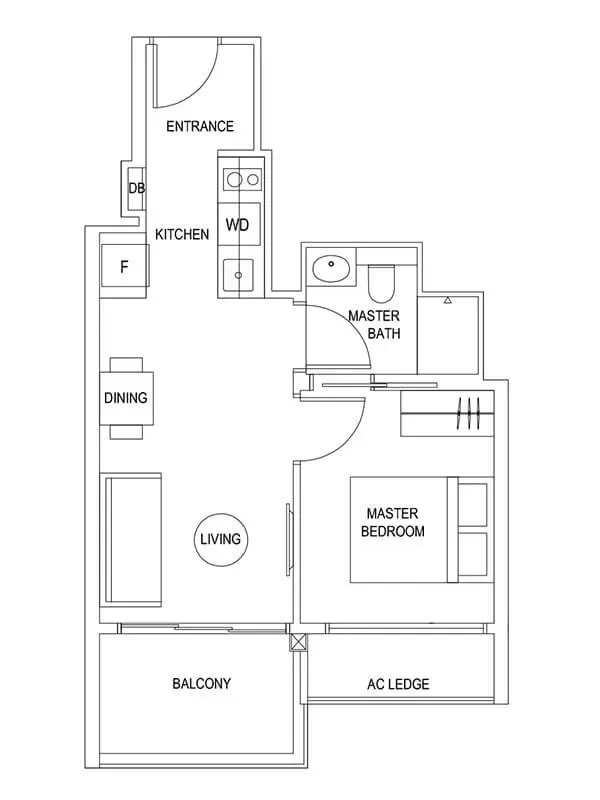

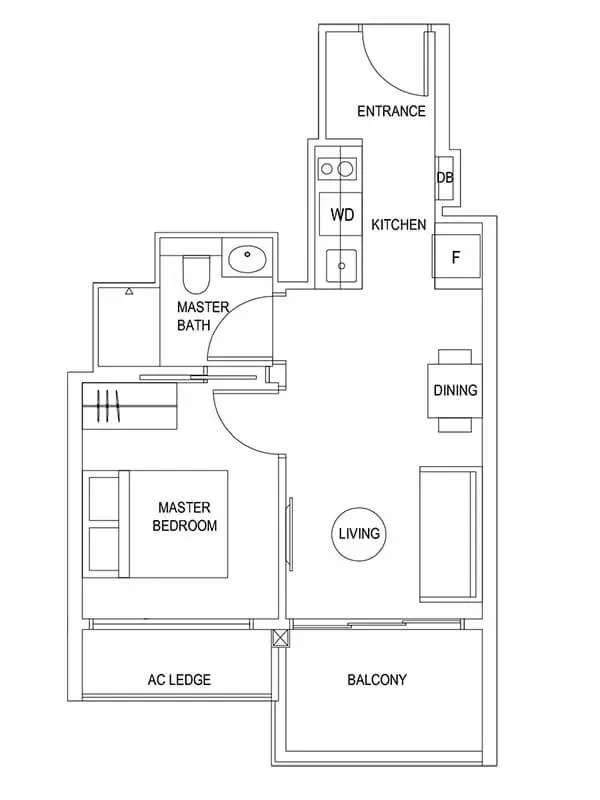

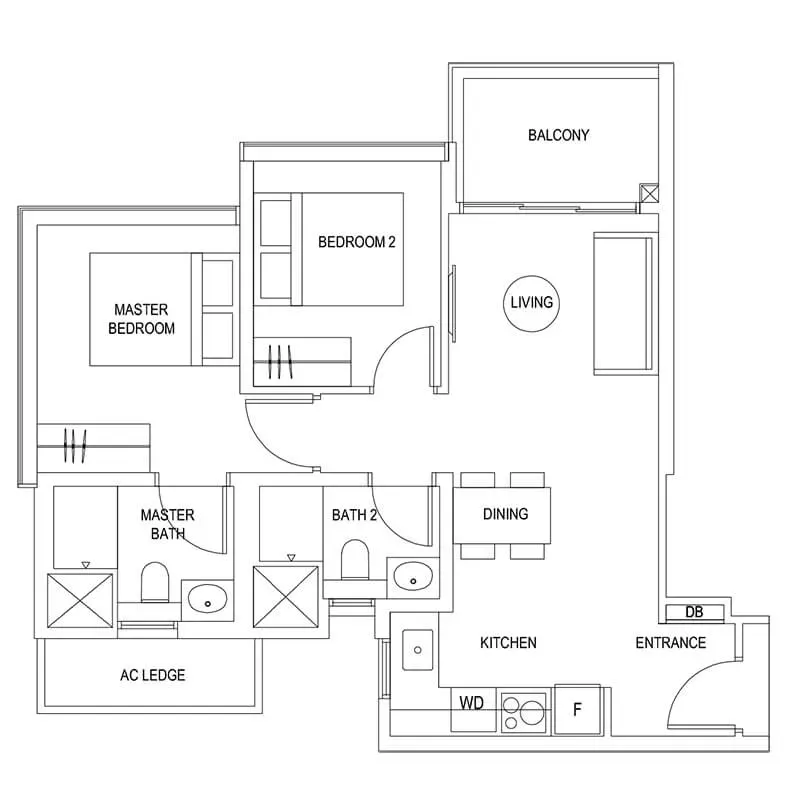

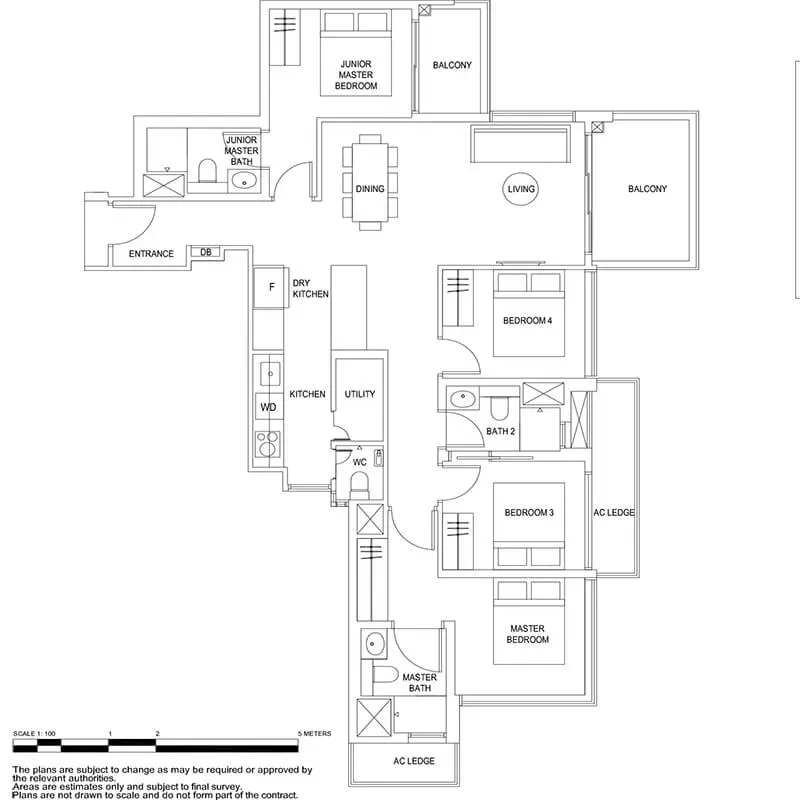

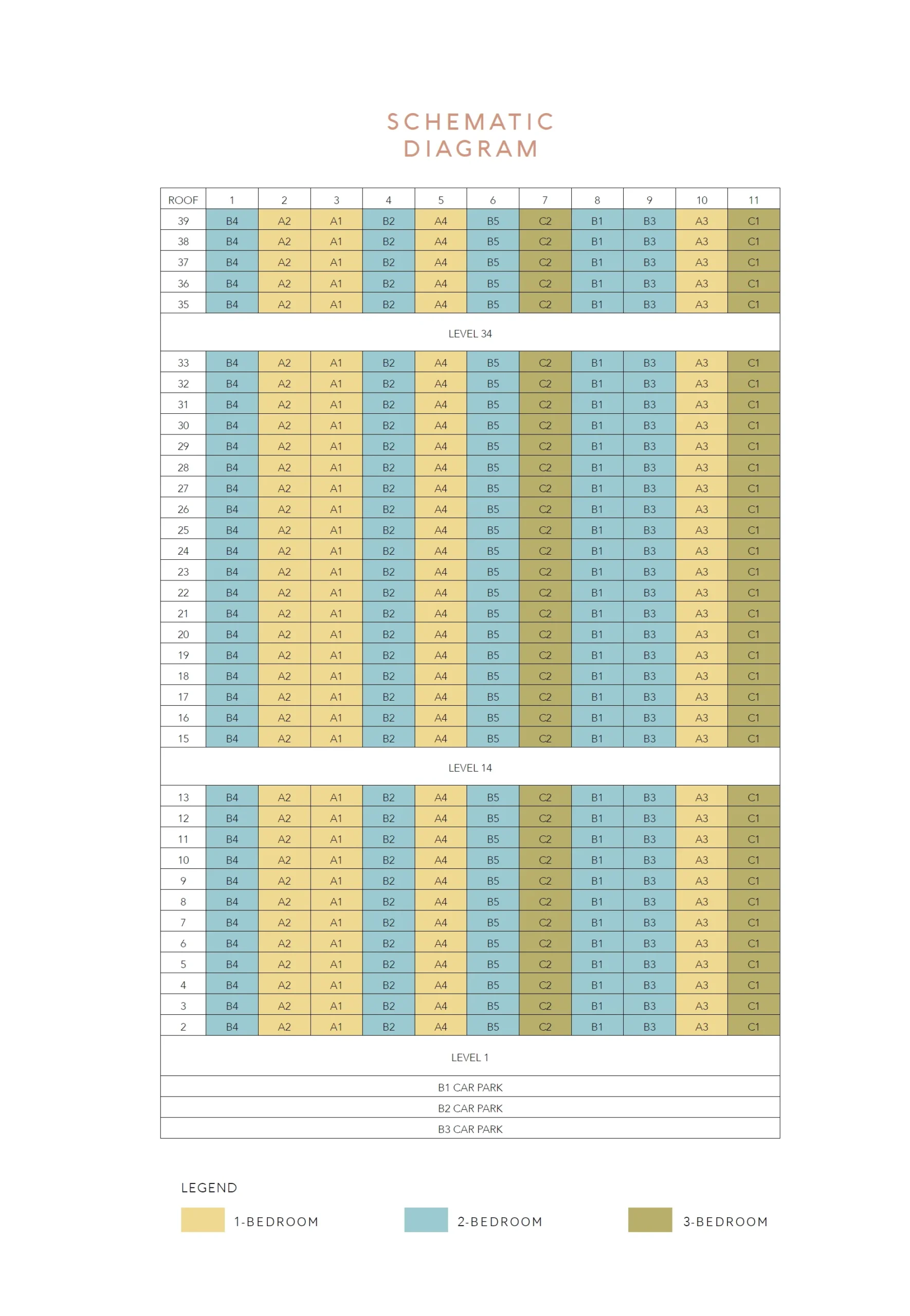

Floor Plans

85 units

Project Details

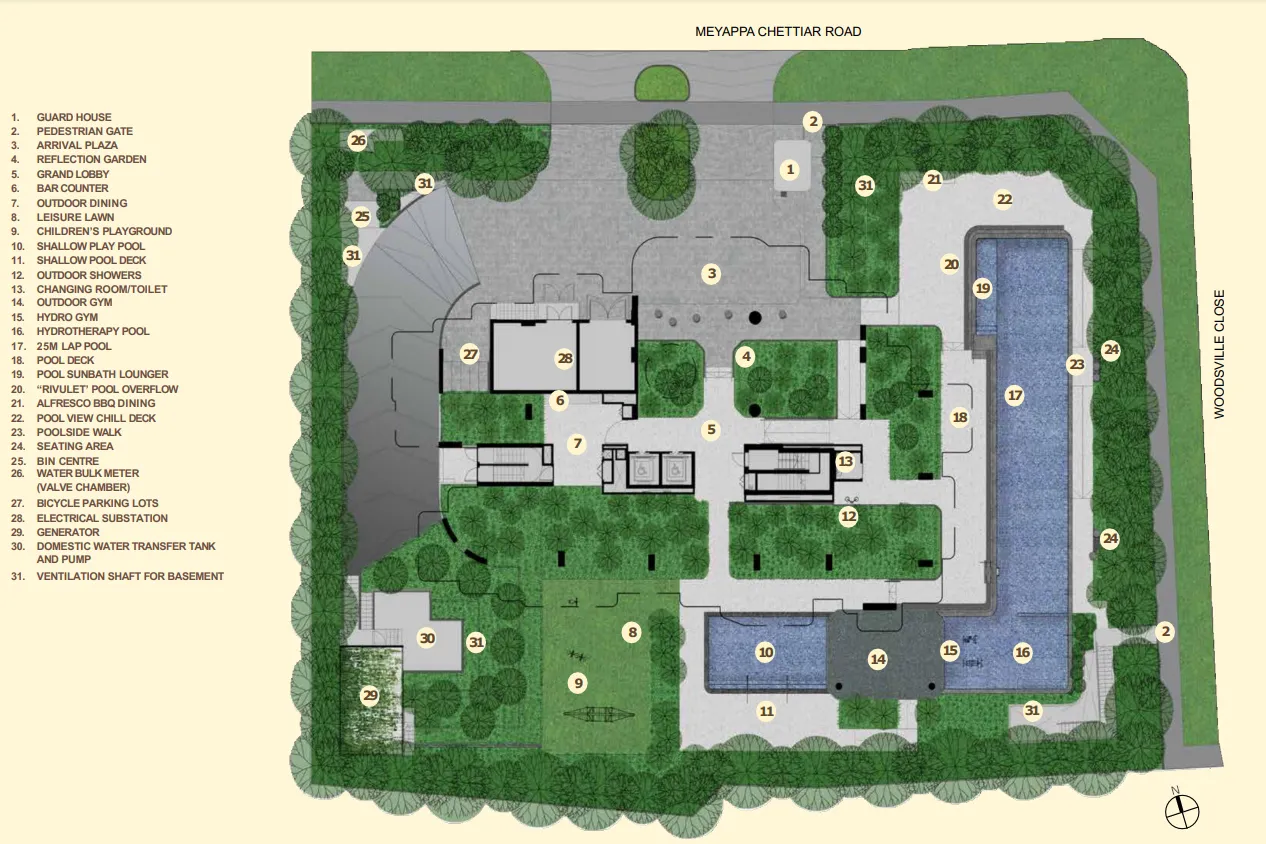

SitePlan

Amenities

-

Swimming Pool

Pool deck, Lap Pool, Outdoor Shower , -

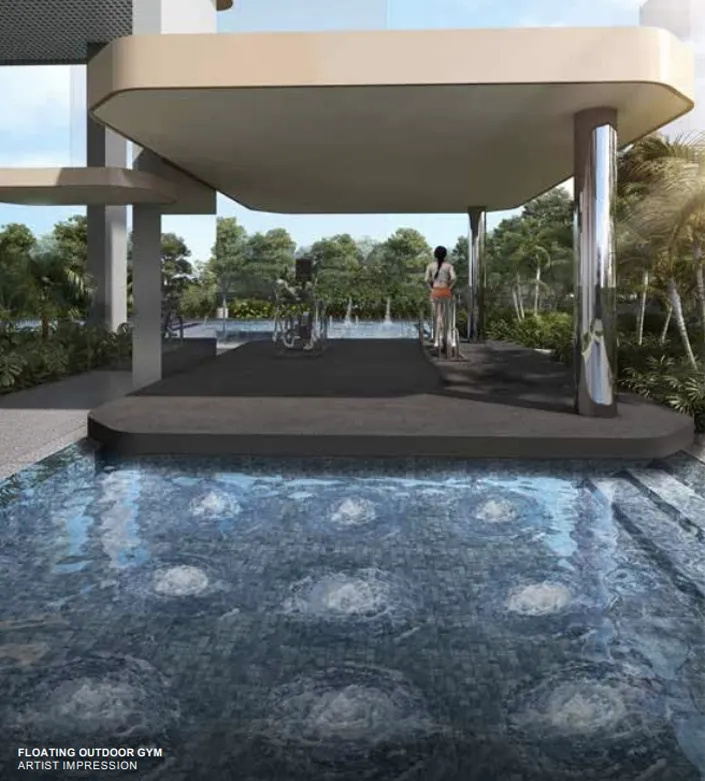

Gym

Outdoor Gym, Hydro Gym -

Parking

Underground Parking -

Garden and Landscaping

Garden Available -

Children's Play Area

Playground -

BBQ

BBQ Dinning -

Function Rooms/lawns

Lawn -

Spa and Wellness Center

Hydrotherapy Pool -

Lounge

Sunbath -

Outdoor Dining

Outdoor Dining -

Tennis Court

Court

Showflat

Balance Unit

Balance units for Myra

Developer

Tiara Land Pte Ltd (Selangor Dredging Berhad)

Myra, proudly hailed as a “work of art,” is crafted by Selangor Dredging Berhad (SDB). The land on which Myra stands is a fusion of 17 individual land plots, all privately owned by different landlords. The developer acquired these plots collectively for $60.2 million in 2018. Anticipated to be finalized in 2024, the development is currently in progress, with a 20% take-up rate for its 85 residential units.

The Myra Condo Developer, SDB, boasts a track record of completing 5 residential projects in Singapore, with 3 more in the pipeline, including JUI Residences, Myra, and One Draycott Park. In Malaysia, the group has successfully delivered 16 office, service apartment, and residential projects, primarily focusing on boutique developments with freehold status. SDB has earned international acclaim, receiving prestigious awards such as FIABCI Prix d’Excellence, Asia Pacific Property Awards, and the EdgeProp Malaysia’s Best Managed Property Awards. The developer aspires to establish itself as the premier real estate developer in Asia in the near future.

As of now, 17 out of the 85 residential units at Myra Residences have been sold at an average price of $2,000 to $2,100 per square foot. The 2-bedroom apartments have proven particularly popular, with approximately 10 units sold. The developer is currently offering attractive promotions at affordable prices. Interested parties are encouraged to contact them promptly to schedule a visit to the showflat and select their ideal home at Myra Condo.

For over six decades, SDB has evolved since its inception in 1962 when Mr. Teh Kien Toh founded Selangor Dredging Limited. Listed on the main board of the Kuala Lumpur Stock Exchange in 1964, the company initially focused on tin mining, becoming the first Malaysian company to construct and operate a dredge. In the early 1980s, SDB embarked on diversification, engaging in various activities, including hardware manufacturing and retail manufacturing of tire rims.

After a period of consolidation concluding in 2004, SDB is now exclusively dedicated to property activities, encompassing hotel management, property leasing, and its primary business of property development. Recognized as an award-winning developer, SDB is renowned for its niche property developments characterized by innovative concepts and designs.