Navigating the multifaceted landscape of real estate acquisition in Singapore can be a daunting task, especially when it comes to understanding the intricacies of the Additional Buyer’s Stamp Duty (ABSD). More than just another tax, ABSD has significant implications for property buyers, dictating costs and investment strategies. This comprehensive singapore-guide pulls back the curtains on ABSD, empowering Singaporean citizens, permanent residents, and foreign investors with the knowledge needed to make informed property purchase decisions.

What is ABSD?

Additional Buyer’s Stamp Duty (ABSD) is an extra tax levied on certain property transactions in Singapore. It applies on top of the Buyer’s Stamp Duty (BSD) and primarily affects buyers purchasing additional residential properties. The ABSD rates vary based on the buyer’s profile—whether they are a Singapore Citizen (SC), Singapore Permanent Resident (PR), or a foreigner.

ABSD was introduced to regulate the property market, curb speculative buying, and stabilize housing prices. Over time, rates have been adjusted to reflect market conditions and government policies. Understanding ABSD is crucial for anyone looking to invest in Singapore’s real estate landscape, as it directly impacts affordability and financial planning.

For a more in-depth look at ABSD, including how it is calculated, exemptions, and mitigation strategies, refer to our comprehensive ABSD singapore-guide.

Understanding ABSD Rates

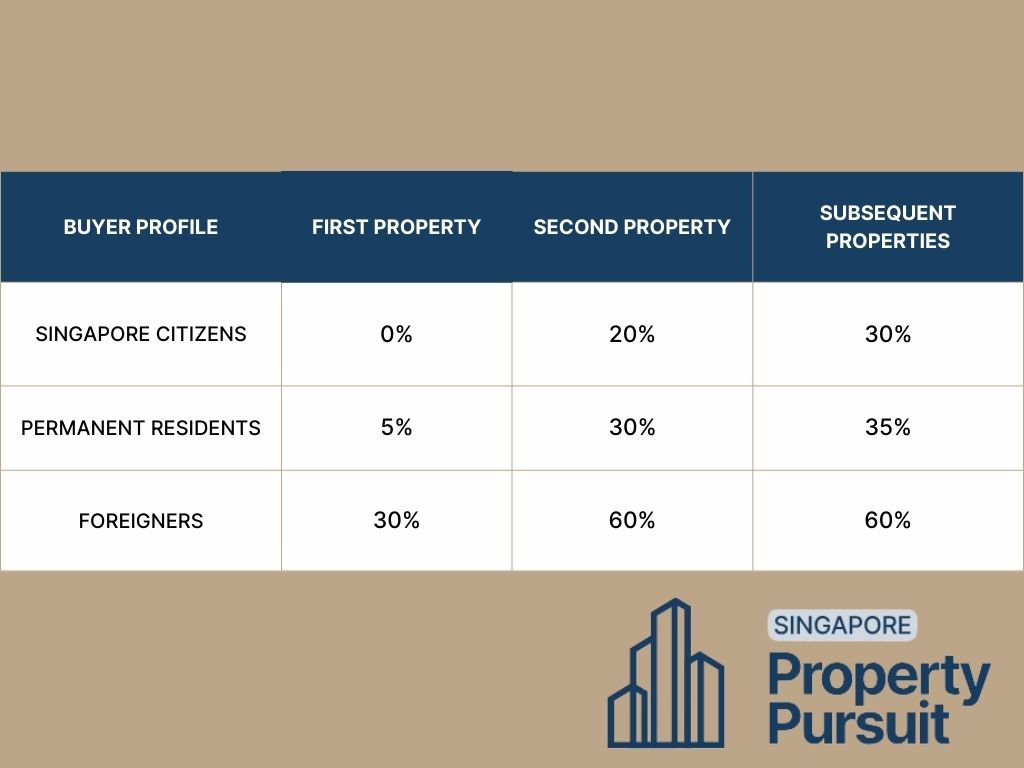

One of the pivotal elements of the ABSD policy is its tiered rates which vary based on the buyer profile and the number of properties under their ownership. Singapore Citizens, Permanent Residents (PRs), and Foreigners have distinct ABSD frameworks, influencing their property purchase considerations significantly.

The ABSD Table

ABSD rates are regularly updated to align with the government’s objectives and market conditions. For a holistic understanding, it’s crucial to view the most current ABSD table that delineates the charges for different categories of buyers. The presented ABSD table clarifies the percentage rates for first-time property purchases, second properties, and any subsequent acquisitions, classifying them by buyer category:

With clear categorization and structured delineation, this chart simplifies what can initially appear as complex calculations related to property tax.

Calculating ABSD

The computation of ABSD is as critical as the rates themselves. It is applied on the purchase price or market value of the residential property, whichever is higher. Understanding this process can demystify the apparent opaqueness of ABSD and provide property buyers with a clear expectation of additional costs. Whether you’re dealing with multiple properties or housing units, knowing the ABSD rates applicable to each scenario is essential for accurate financial planning.

Colour-Code for Clarity

Leveraging visual representations can enhance accessibility to complex information. Colour-code the ABSD rates for Singapore Citizens, PRs, and Foreigners to improve comprehension and retention. This approach allows buyers to quickly identify the rates relevant to their specific circumstances, making it easier to navigate the same ABSD rate applied across different property types.

Additional Considerations

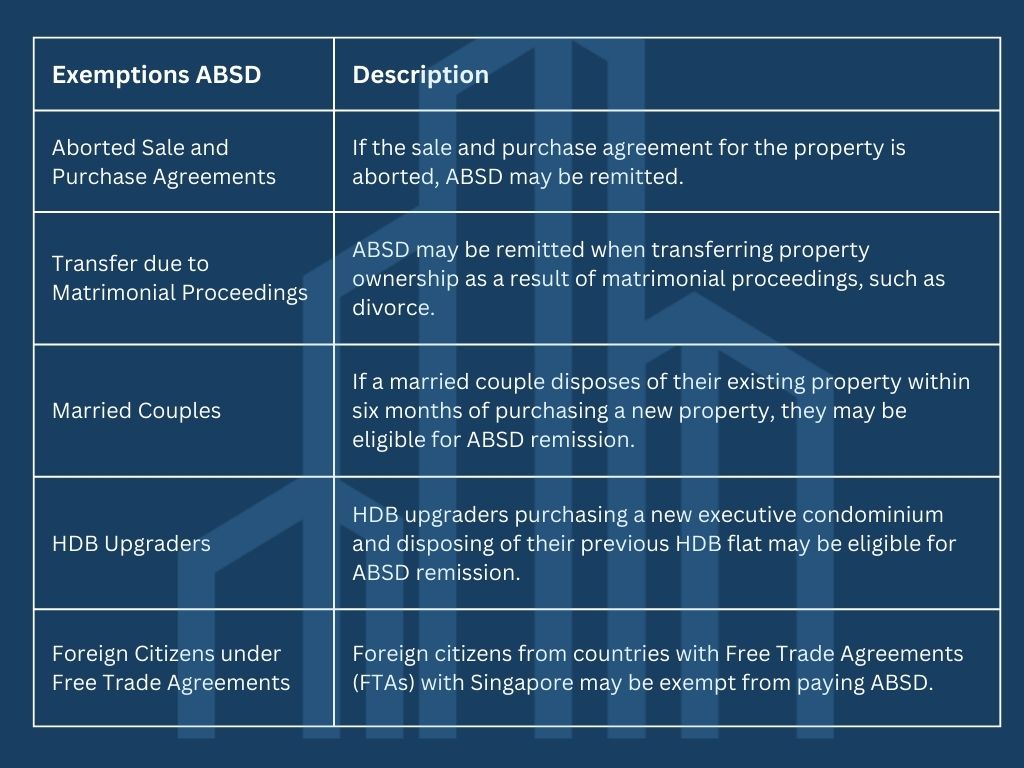

While knowing the standard ABSD rates is crucial, it’s equally important to understand potential exemptions or remission schemes that could apply, especially for unique situations like inheritance or when a buyer transitions from being a PR to a Singapore Citizen. These exemptions can significantly impact the overall cost of acquiring additional housing units, offering relief in specific cases.

Additional Considerations

While knowing the standard ABSD rates is crucial, it’s equally important to understand potential exemptions or remission schemes that could apply, especially for unique situations like inheritance or when a buyer transitions from being a PR to a Singapore Citizen.

Potential Exemptions and Schemes

Outlined in bullet points, provide a high-level overview of potential scenarios where ABSD exemptions or remissions could be granted.

Directing to Reliable Sources

Direct readers to the official IRAS website or a specific page with current ABSD information. This inclusion reinforces credibility and ensures readers can find real-time data for their decisions.

Planning Your Purchase

Looking at ABSD as a financial factor in property purchases can change how investors approach budgeting. By understanding the cost implications up front, buyers can more carefully plan their investments.

Budgeting with ABSD in Mind

Use an illustrative example to showcase how ABSD affects the overall budget for a property purchase, enhancing the practical application of this understanding for readers.

The Role of Property Professionals

Discuss the importance of consulting with industry experts who are familiar with the intricacies of Singapore’s property laws and taxes, emphasizing the role they play in navigating ABSD.

Can You Avoid ABSD?

The prospect of sidestepping ABSD altogether often piques the interest of buyers. While there’s no guaranteed loophole, certain strategies may reduce the ABSD liability for some.

Reducing ABSD Liability

Mention strategies like buying under a spouse’s name, decoupling ownership, or considering different property types that could impact ABSD, but stress the importance of personalized advice from financial and legal professionals.

The Conclusion

Summarize the key takeaways and encourage proactive research to further understand the implications of ABSD on property purchases in Singapore.